Wednesday, August 5, 2015

Record high and still-climbing inventories, sturdier transportation and storage infrastructure, and lessons learned are prompting optimism that the nation is in a much better position today to weather a repeat of the perfect storm experienced in winter 2013-2014. That nightmare heating season, characterized by a supply and logistics outlook that morphed from good to bad in a heartbeat, is unlikely to replay, yet remains fresh in the memory of the propane industry.

Rather, with increasing production near demand regions and better pipeline and rail connectivity, as the nation heads into winter 2015-2016 the retail propane industry is in an excellent position to navigate the uncertain waters of today’s energy markets, noted Houston-based RBN Energy in a presentation July 14 at a meeting of the Propane Education & Research Council in Park City, Utah. However, it will be increasingly important for retailers to carefully monitor export markets, export volumes, and Gulf Coast petrochemical demand going forward as demand ramps up in those high-consuming sectors.

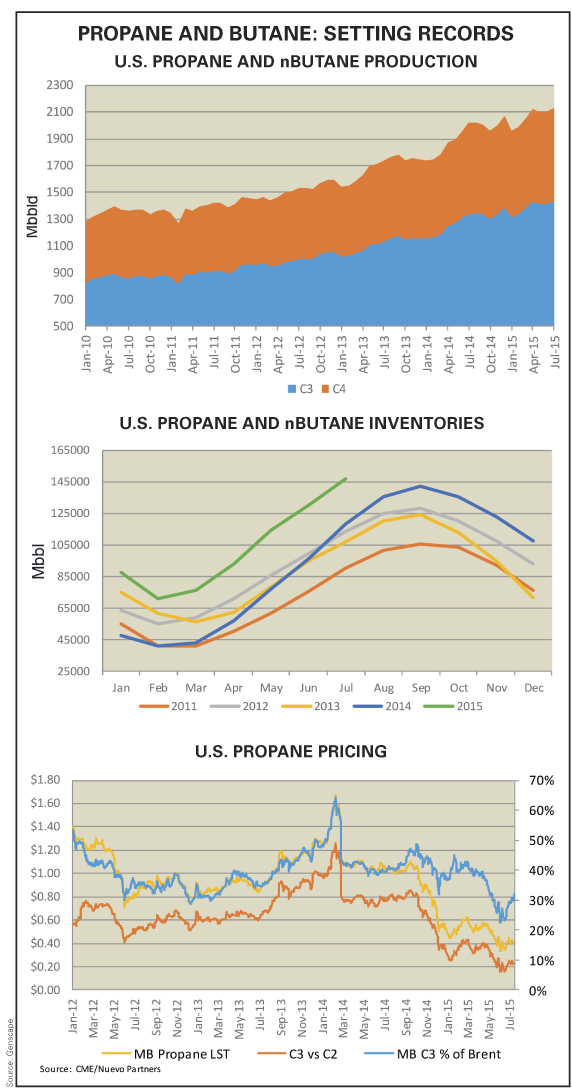

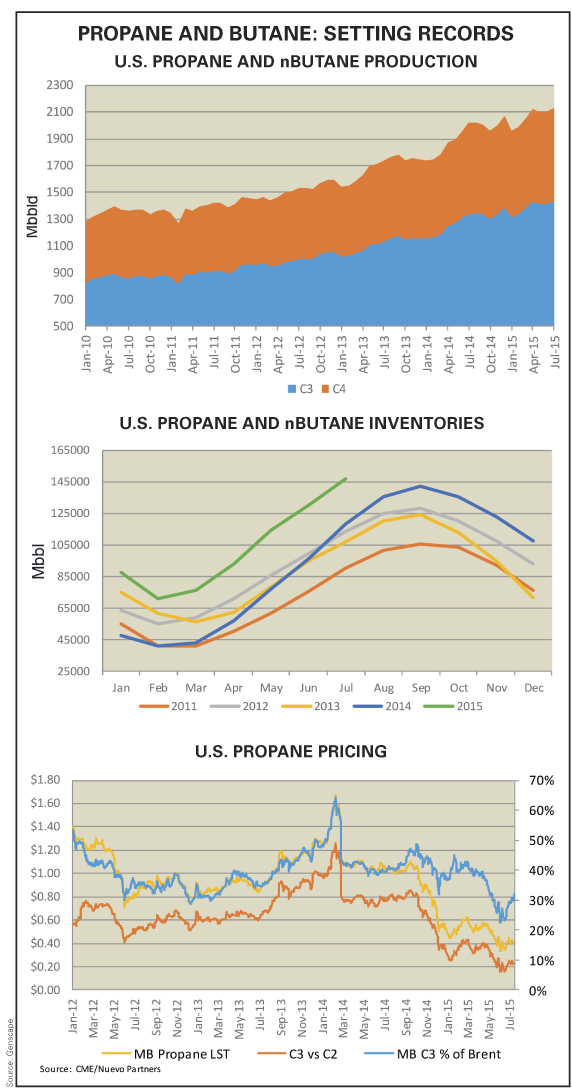

Meanwhile, the global commodity market intelligence consultancy Genscape (Louisville, Ky.), in a webinar July 21, also pointed to record-high U.S. propane inventories and production, as well as drawing attention to record-low prices, rock-bottom percentage values compared to crude oil and ethane, the latter, like propane, a petrochemical feedstock, in addition to record basement prices for American propane versus international valuations.

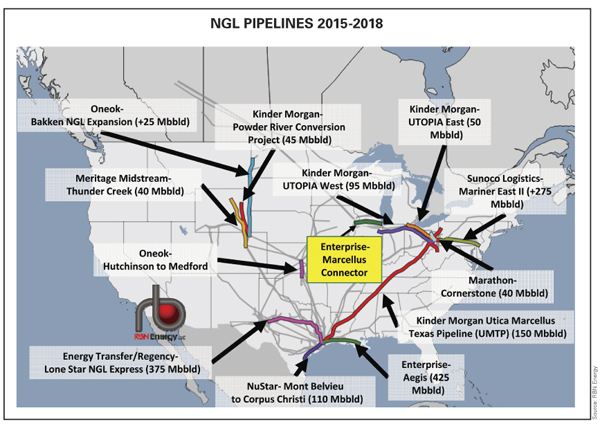

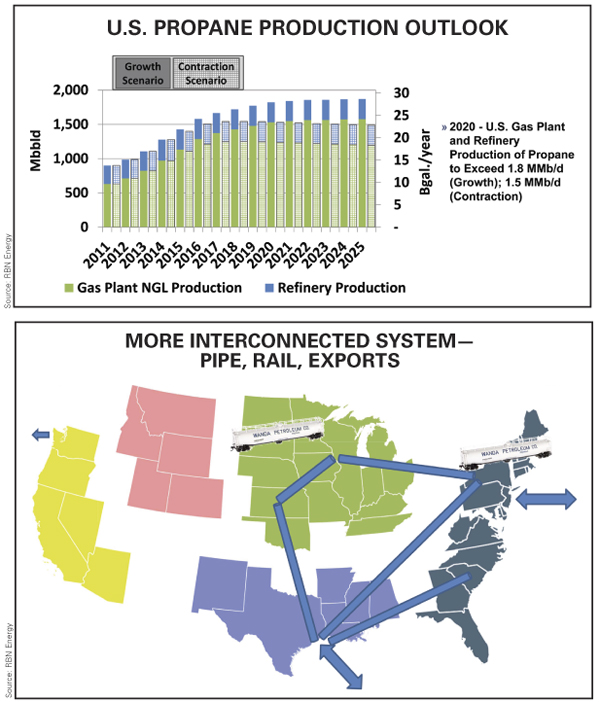

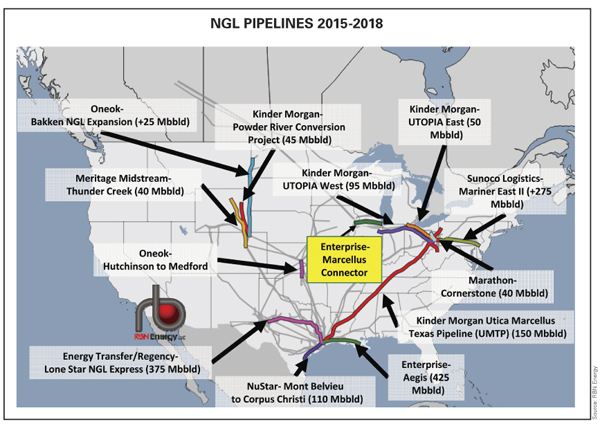

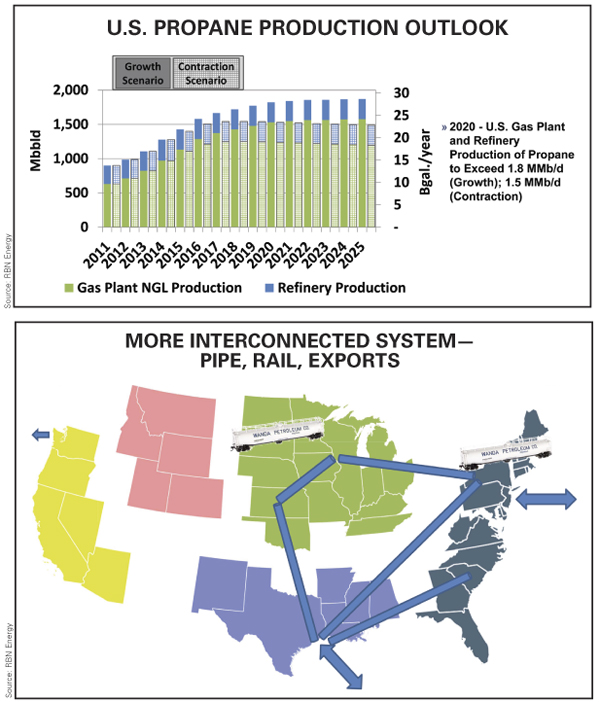

RBN’s Rusty Braziel and Ron Gist highlighted that U.S. propane production has more than doubled, and new production is closer to major market areas such as the Northeast and Midwest, “right where we want it to be,” observed Braziel, adding that 14 new projects currently under way are creating a “giant funnel to Mont Belvieu.” In addition, a significant number of new rail facilities are coming online, and new pipeline, storage, export, and rail infrastructure equates to a more interconnected market. And while that interconnectivity is positive, RBN cautioned that regional markets would therefore see more significant impacts from disruptions in other regions. Braziel and Gist also advised that rail transportation is less ratable than pipeline deliveries; manifest shipments are not a priority for railroads, calling into question just-in-time reliability.

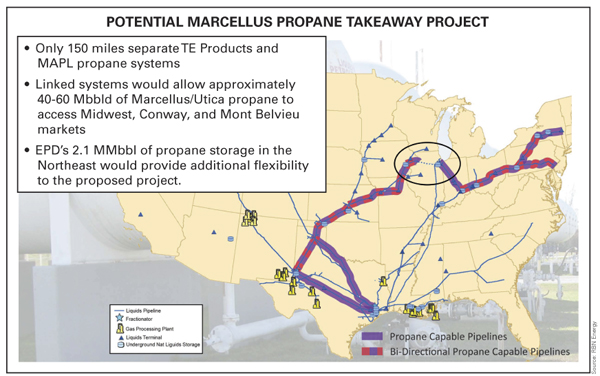

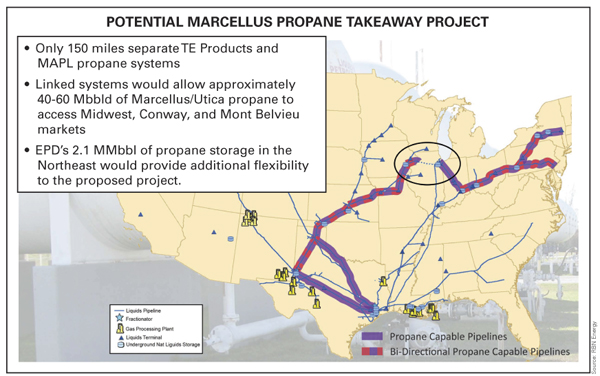

Moreover, during the 2015-2018 timeframe, if all planned U.S. natural gas processing expansions are built and fully utilized, an additional 200,000 bbld, or about 3 Bgal., of propane will be added to the supply mix. Further, fractionator expansion projects promise to add 1,050,000 bbld of capacity over the same period.Among the proposed pipeline projects being considered is Enterprise Products’ (Houston) Marcellus connector initiative, RBN reported, which would connect the top ends of the TEPPCO and MAPL bidirectional propane systems. Enterprise comments that only 150 miles separate TEPPCO and MAPL, and linking the systems would allow 40,000 to 60,000 bbld of Marcellus/Utica propane to access the Midwest, Conway, and Mont Belvieu markets. Enterprise’s 2.1 MMbbl of propane storage in the Northeast would provide additional flexibility for the proposed takeaway project.

At the same time, RBN said rail utilization for some major propane retailers has climbed 10% to 20% over the past two years. There are about 55,500 pressure cars with 30,000-gal. capacity in the fleet, based on June data from the American Association of Railroads. Estimates have 50% in LPG service, of which 75% are in propane service. Railcars are used in propane service 60% of the year, but are full only 50% of the time, implying 187 MMgal., or 4 MMbbl, of propane are in rolling storage, RBN said, adding that an estimated 88,000 carloads of propane have moved this year. Rail terminal storage, meanwhile, was set at 1.1 MMbbl, or 46 MMgal. The disbursement of those gallons includes 10.5 MMgal. in the Northeast, 14.7 MMgal. in the Midwest, 15.8 MMgal. in the Gulf Coast, 0.6 MMgal. in the Rocky Mountain Region, and 4.2 MMgal. on the West Coast.

RBN added that primary propane storage capacity is at 136 MMbbl, or 5.7 Bgal., with the majority of that in PADD 3, the Gulf Coast, and PADD 2, the Midwest. The consultancy pegged residential propane tank storage capacity—households using propane for space heating, water heating, and cooking—at 132 MMbbl, or 6.4 Bgal. Of that, 1.5 Bgal. are in the Northeast, 2.5 Bgal. in the Midwest, 1.0 Bgal. in the Gulf Coast, 0.8 Bgal. in the Rocky Mountain region, and 0.5 Bgal. on the West Coast.

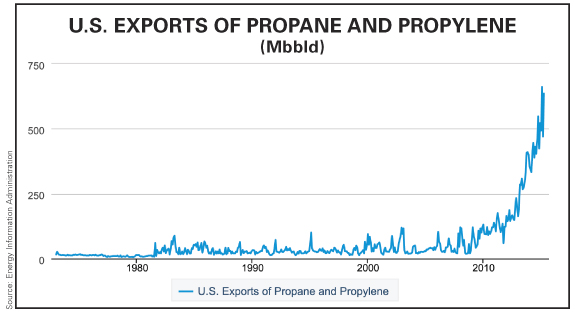

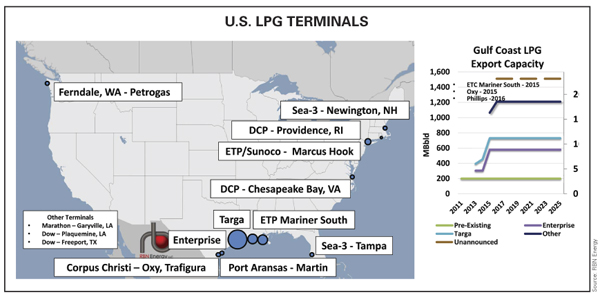

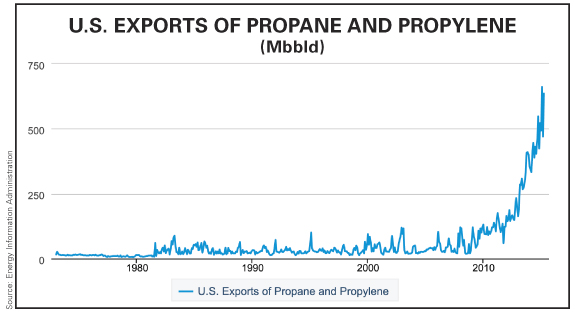

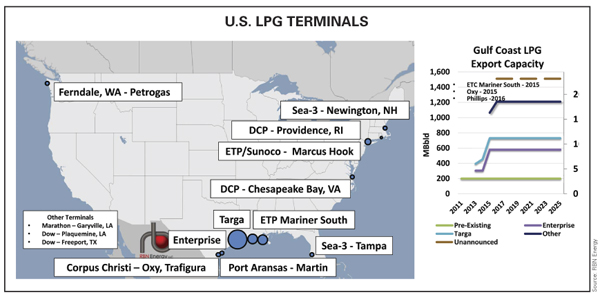

Turning to the propane export market, Braziel and Gist noted that capacity stands at 1.2 MMbbld now, and soon could grow to 1.5 MMbbld. In July, a reported 700,000 bbld left from the Gulf Coast alone. They added that most LPG export contracts are not affected by seasonal demand since they are with year-round end users such as ethylene crackers, propane dehydrogenation (PDH) plants, cooking and autogas buyers, and power generators. The most dramatic change in LPG exports will occur in mid-2016 with the opening of the Panama Canal expansion. This will allow the entire global very large gas carrier (VLGC) fleet to transit the canal for voyages to the Far East. Currently, only specialized Panamax vessels can pass.

Emerging production and product flow shifts are also favorable. In its forecast, RBN established contrasting contraction and growth scenarios. Contraction assumes a continued low commodity price environment, while growth is based on a more robust market. That growth scenario sees resilient production keeping volumes growing; West Texas Intermediate (WTI) crude oil, the U.S. benchmark, returns to the $80/bbl range by 2017 and $95/bbl by 2020. Contraction means the scenario is still resilient, and some production totals see 2014-2015 year-over-year growth, but production declines begin in 2016. WTI prices average $50/bbl in 2015 and only reach $65/bbl by 2020. Short hand: production increases will be largely based on U.S. benchmark oil prices; when crude is priced higher, producers drill more, and the higher the price, the more NGLs are recovered. Conversely, low oil prices weigh on all drilling activities, both gas and crude.

Under those opposing views, by 2020, propane production on the East Coast — Marcellus/Utica — would increase to between 200,000 bbld (contraction) and 300,000 bbld (growth) — to 3 to 4.6 Bgal. a year, respectively. Regardless of ei ther scenario, traditional inbound flows on TEPPCO from the Gulf Coast and by rail from various supply points will be displaced by local production moving on rail and the north end of TEPPCO. Rail from local fractionation facilities will make up a larger portion of supply. Some winter inbound flows on TEPPCO will continue to make up for storage capacity shortfalls. The region will also see new demand from a new PDH unit at Sunoco Logistics’ Marcus Hook, Pa. industrial complex, as well as waterborne exports from Marcus Hook.

Propane production in the Midwest region is seen as increasing to between 425,000 bbld and 500,000 bbld to reach 6.5 to 7.7 Bgal. a year over the period, depending on contraction or growth. Additional production is primarily centered in North Dakota’s Bakken formation, with barrels from Canada and Oklahoma contributing. New rail facilities replace Cochin pipeline deliveries.

By 2020, RBN expects propane production in the Gulf Coast to rise to between 975,000 bbld and 1.1 MMbbld and stand from 15 Bgal. to 17 Bgal. a year. Production growth within the region and flows from the Midwest will move mostly to exports, with some demand increases from new PDH plants. In the Rocky Mountain region, production is forecast to increase to between 130,000 bbld and 140,000 bbld and stretch to 2 Bgal. to 2.2 Bgal. a year. Most production gains will move to the Midwest via pipeline. Finally, the West Coast remains virtually unchanged at 65,000 bbld, or 1 Bgal. a year. Some small-volume propane exports will leave the U.S. from Ferndale, Wash.

Prices

Braziel and Gist underscored that propane prices are determined by fundamentals —the interaction of supply (production, imports, inventory levels) —and demand (weather, petrochemical usage, and exports). “The most significant correlation to propane prices is the price of crude oil due to propane’s competition with other petrochemical feedstocks that vary with crude oil, and the production of propane from crude oil refineries.” Although below 30% recently, propane’s value as a percentage has averaged 44% of WTI since 2012. Changes in that percentage are determined, primarily, by the supply/demand balance of propane.

Therefore, propane prices will be higher in RBN’s growth scenario due to higher crude prices. Although prices will be lower in the contraction outlook, the ratio to crude will be higher due to a tighter supply/demand balance. “This tightness results from lower propane production, but a strong pull on export volumes due to ‘sunk cost’ investments in terminals and ships.” In other words, such investments are contracted in advance. Costs are entrenched — sunk. Further, lower U.S. propane prices sustain the attraction for exports since shipments offshore depend on a discount to world prices that is still low enough when shipping costs are added. When U.S. and international prices balance, exports decline.

Concluding, RBN views production growth adjacent to, and within, the Northeast demand region leading to even more shifts for supply to local sources. A higher proportion of supply will be delivered by rail, but Dixie Pipeline and TEPPCO will continue to be important sources. Overall, TEPPCO volumes will be boosted by Marcellus/Utica production. Therefore, retailers should focus on local supplies for ratable volumes, supplemented by seasonal purchases from pipeline, rail, and local storage. However, the intermittent nature of rail deliveries will require more planning and scheduling to avoid supply disruptions.

In the Upper Midwest, propane will increasingly be supplied by Bakken and other Midwest production, with much of it delivered by rail. Retailers previously served by the Cochin pipeline or by new rail terminals will need to plan for more intermittent deliveries. Marketers served from the MAPL or Oneok systems can continue to rely on consistent deliveries from those sources. It’s business as usual, RBN said.

The consultancy advised both Northeast and Midwest retail suppliers to carefully monitor export volumes. Gulf Coast exports “have become a huge gateway to the global propane market,” and “pricing in global markets will increasingly impact pricing in U.S. markets — and vice versa.” Supplies to meet Gulf Coast export commitments, however, will come from production within the region, but with significant receipts of Midwest and Rocky Mountain production. As well, additional demand is coming for new PDH units in the Gulf.

“With increasing production near demand regions, better connectivity from both pipeline and rail, and export volumes that can be bid away from global markets, the U.S. propane industry is in a much better position to handle a perfect storm of events than it was in the winter of 2013-2014,” RBN asserted. “But all supply is local. Retailers must continue to diligently prepare for short-term market events that can disrupt the supply chain. Through careful planning, operational best practices, and prudent contracting, the retail propane industry is in an excellent position to navigate the uncertain waters of today’s energy markets.”

Breaking Even

Bob Simmons, Genscape’s production manager, NGLs, observed during the consultancy’s late-July webinar that production breakeven values have decreased since October 2014, leading to a reduction in rig counts. Although producers are focusing their efforts in core play areas, leading to an increase in NGL gallons per Mcf of natural gas processed, weak commodity prices, including NGLs, are contributing to lower breakeven prices. Active rigs have decreased 60% from the October 2014 peak, and all regions have been impacted, although the Northeast region has had the lowest reduction. Simmons said June appears to have been the bottom of the fall, since in July rig counts climbed and are forecast to rise further in the current price environment. However, rig counts are seen falling again in 2016.

In addition, Genscape sees natural gas and crude oil production peaking this summer, with reduced drilling, deferred well completions, and natural declines leading to lower production in 2016. Within this landscape, right now gas plant production of propane and butane per Mcf of natural gas processed is increasing, which relates to producers focusing efforts in the core acreage of liquids-rich shale plays. Future results call for flat to growing production of those liquids, while natural gas production is expected to decline.

Simmons’ outlook calls for lower-48 propane production in the upcoming winter to be flat versus summer 2015, although growth continues to occur in the Northeast. Though PADD 3, mainly Texas, growth has been robust from this past spring, Genscape expects that growth to slow down over the second half of this year. Nonetheless, producers continue to complete more wells than expected, leading to increased natural gas growth in core acreage with high gallons of NGLs recovered per thousand cu ft (GPM). Operating rates at new natural gas processing plants are estimated to be greater than 85%, and an additional 5 Bcfd of capacity is scheduled to come online between now and the end of this winter.

Addressing petrochemical demand, Amanda Townsley, senior advisor, NGLs, for Genscape noted that propane and butane remain competitively advantaged versus ethane for cracking. Cracking operating rates have been strong, with low levels of planned outages. Propane demand for cracking should increase, but concerns regarding propylene oversupply and wintertime spikes remain. In addition, new PDH demand coming online will soon add 30,000 bbld to 35,000 bbld on top of present cracking demand for propane. Petrochemical users, depending on price, may prefer propane to ethane. On a volumetric basis, propane yields 17% propylene compared to 3% for ethane, she said.

Genscape compared propane exports to the 800-lb gorilla in the room. Those shipments are expected to increase due to the growing VLGC fleet and cheaper and available freight. “From 35 to 40 boats will be commissioned this year, with another 40 to 50 vessels arriving next year,” she said. “Compare that with only eight new vessels in 2014.” As well, new export terminal capacity will contribute — 7 MMbbl a month is coming online by the end of this year —and it’s fully contracted. Townsley commented that she expects exports to continue leaving U.S. shores at a 700,000-bbld rate throughout the upcoming U.S. winter demand season.

Genscape summarizes that, “though starting off demand season at record-high inventories, lack of growth in supply plus new export capacity provide the likelihood for above-average rates of draw for propane and butane.” Butane and propane are currently priced out the forward curve for maximum cracking, although butane may not be targeted as much.

Although Far East propane versus Mont Belvieu is backward going into 2016, freight rates will likely adjust to encourage continued exports, although capacity will likely be underutilized. And assuming normal weather in winter 2015-2016, propane inventories should retrace close to the historical average by the end of the heating season, drawing 20 MMbbl more than last year, “the material chunk of the overhang,” according to Townsley.

So, the outlook is bullish, right? Genscape responds: Well, sort of. “We believe that butane and propane have the potential to appreciate as they normally do seasonally. However, upside versus other energy is limited by the continued need for LPG to price for economically sensitive demand — if not domestically, then internationally. Any large changes in LPG flat price during demand season are likely to be driven by external forces, e.g., crude pricing or potentially extreme global weather.”

Bullish: production growth is slowing at this price deck; lower pricing is supporting demand growth for cracking and consumption; new capacity and ships are yielding higher exports; and the demand season is approaching. Bearish: Unless exceptional weather or demand requires competitive pricing, the upside is capped.

Crop Drying/Weather

Josh Senechal, a member of Genscape’s meteorology team, commented that the Corn Belt so far this year has experienced relatively cool weather, with no significant heat. “Below-normal temperatures have persistently impacted the Midwest, with more appreciable warmth limited to the southeastern and western U.S.,” he said. But heavy rainfall has impacted the eastern two-thirds of the Corn Belt, resulting in high surface moisture content.” There’s been a wet June, but a drier July. Grain dry-down needs are seen to be high this season, but not off the charts as in the lead-up to winter 2013-2014.

Heading into August, Senechal forecasts cooler temperatures, and with the early corn planting, crop maturity is expected to be normal. The combination of heavy rainfall across portions of the Midwest and a general lack of heat into fall suggests strong usage of propane for crop drying. In addition, wet risks during September across the southern Midwest suggests the presence of excess grain moisture for nearly 50% of major growing areas. Dry-down needs will be lowest across the western and Upper Midwest where conditions will be drier, he predicted.

Senechal added that the El Niño oscillation is expected to be the primary forecast driver heading into the winter months. Moderate to strong El Niño conditions are currently in place and are expected to persist through the winter months. The result, warmer weather across the northern half of the U.S., and bearish propane demand there.

He highlighted that 1957-1958, 1987-1988, and 1997-1998 stand out as the top-three winter analog years for El Niño due to the presence of moderate to strong conditions. Comparing those years suggests broad coverage of above-normal temperatures across the northern half of the U.S., with below-normal temperatures across the South. “This should result in below-normal propane demand with weaker demand in comparison with last winter,” Genscape’s meteorology team member said.

The consultancy maintains that, historically, U.S. crop-drying demand has held a wide range from about 1 MMbbl to 9 MMbbl during October and early November. Last year, demand was listed at about 3 MMbbl. This year that total is likely to be more than the minimum, but not above last year.

Weighing in on heating demand, Genscape characterized the draw varying by as much as 40 MMbbl between a warmer versus a cold winter, with last winter being a bit colder than normal, but nothing compared to the previous heating season, which was exceptionally, and enduringly, frosty. Year-over-year, the forecast for this winter compared to last, according to Genscape, is expected to be lighter by 4 MMbbl for propane, although affordability may prompt some households to burn additional gallons to stay extra toasty.

Augmenting the webinar discussion, in a white paper it published in July, Genscape framed the “delicately balanced” natural gas liquids supply chain that has emerged recently in the U.S. Northeast, where production from the prolific Marcellus and Utica gas plays has amassed the largest NGL liquid reserves in the U.S. The paper spotlighted that production growth has sparked a wave of new infrastructure to gather, extract, and process NGLs in the region, an area previously lacking in such infrastructure. And in turn, Marcellus and Utica natural gas production has become dependent on the continuous operation of each infrastructure node, meaning disruptions can have a large ripple effect across the entire system.

“The deep connectivity of gas production to NGL processing and transportation infrastructure is unprecedented, and insight into real-time fractionation and NGL pipeline operations provide upstream and downstream market participants with critical, price-sensitive information,” the consultancy said, referencing monitoring services it provides.

Noted was that the Marcellus and Utica natural gas plays have an estimated 1 MMbbld of raw NGL potential. Production growth in the plays has increased steadily since the end of 2012, growing from 45,000 bbld to 392,000 bbld this year. NGL production in the NGL-rich gas shale plays is expected to continue to grow, while the growth rate is slowing elsewhere in the U.S. The Northeast is forecast to grow by 75%, or by 168,000 bbld in 2015 relative to the previous year, according to Genscape. By the end of 2016, NGL production is expected to near 600,000 bbld in the U.S. Northeast.

This rapid NGL growth has resulted in the creation of an NGL production center outside of the North American NGL hub at Mont Belvieu. But unlike Mont Belvieu, the Northeast hub is a unique NGL production center where gas production and processing is in close proximity and is tightly integrated to NGL extraction, processing, and transportation. Therefore, “a supply chain has developed that includes operational capacity for extraction of liquids, fractionation of raw NGLs to purity products, and the transport of those products to the downstream market. However, there is a lack of spare capacity inherent in this supply chain for storage and transportation, and a lack of interconnectivity between regional fractionation trains.”

Genscape comments what further complicates the delicacy of the natural gas and NGL supply chains is the high ethane content of the rich gas produced in the plays. “In general, the ethane percentage content found in raw NGL mix production is estimated to be 50% to 55% in full ethane recovery mode, 5% to 10% higher than other U.S. production areas.”

Dealing with this ethane surplus takes a multifold approach, the consultancy emphasizes. When ethane production becomes uneconomic or supply containment issues arise, ethane rejection — leaving ethane in the outlet natural gas stream — is possible and regularly takes place in the Marcellus and Utica. But, the challenge with this process is that there is a ceiling on how much is allowed due to Btu limits on natural gas pipelines. These Btu limits can restrict additional blending of ethane into natural gas when operational issues arise downstream, resulting in supply containment issues. Shutdowns at de-ethanizers (fractionation trains) downstream, and pipeline issues can all result in an excess of raw NGL and/or purity ethane supply in the Northeast.

Beyond structural ethane limits, a lack of storage capacity and the reliance on rail systems for propane-plus takeaway also leaves the Northeast vulnerable to operational issues. In processing centers like Mont Belvieu and Conway, Kan., the locus of raw NGL production is located away from the hubs. Any disruptions in fractionation or purity pipeline operations are managed with storage capacity, as feedstocks or end-product can be stored if they are in surplus due to operational issues.

Conversely, in the Marcellus and Utica, the landscape is vastly different. Genscape underscores that production is located in close proximity to downstream NGL infrastructure. Unlike Mont Belvieu and Conway, storage for raw NGL and purity products is limited in the Northeast. When purity pipelines slow, as experienced with Sunoco’s Mariner East Pipeline in February, or fractionation trains go offline, the effect is felt all the way to the gas wellhead. “Without storage capacity, NGL production, be it purity product or raw NGL mix from gas processing, must decline in the Marcellus and Utica,” Genscape maintains. “There are two ways this can be accomplished. The first option is to leave as much ethane as possible in the gas stream. But the Btu limits set a ceiling for this type of ethane ‘demand.’ And this is de facto storage for ethane, a relief valve. Once ethane is blended into the outlet as stream, ethane recovery from gas is logistically impossible. The second option, a decline in gas processing rates, ultimately leads to reductions in wellhead natural gas production. Declines in gas processing rates create an upstream bottleneck between the wellhead and the gas plant, and the relief valve is curbing-in gas production.”

The lack of storage, be it physical storage or ethane rejection capabilities, along with a lack of spare processing and transportation capacity in the Marcellus and Utica plays, leaves the NGL supply chain vulnerable to operational disruptions. This delicate balance relies on all nodes of the supply chain to work at the same time. Any disruptions, be they upstream or downstream, have a pronounced effect on price due to the frailty of these fundamentals.

Genscape adds that Marcellus and Utica purity products have diversified demand outlets. Enterprise’s ATEX pipeline connects the region to the Gulf Coast ethane market, but Mariner East and Mariner West also take ethane — and propane in the case of Mariner East — to international markets. In addition, there is potentially new regional demand for purity NGLs from Appalachian crackers or PDH units.

Separate Spots

The consultancy presses that factors, including the inherent delicacy of the Marcellus/Utica supply chain, beg the need for separate spot pricing in the Northeast —independent of Mont Belvieu. “The regional fundamentals are mostly independent of what happens at Mont Belvieu,” Genscape contends. “As such, this increases the basis risk for Marcellus/Utica purity NGLs versus the Mont Belvieu pricing hub. However, emerging spot markets take time to develop, especially with new production, infrastructure, and transportation linked to long-term supply contracts.” —John Needham

Rather, with increasing production near demand regions and better pipeline and rail connectivity, as the nation heads into winter 2015-2016 the retail propane industry is in an excellent position to navigate the uncertain waters of today’s energy markets, noted Houston-based RBN Energy in a presentation July 14 at a meeting of the Propane Education & Research Council in Park City, Utah. However, it will be increasingly important for retailers to carefully monitor export markets, export volumes, and Gulf Coast petrochemical demand going forward as demand ramps up in those high-consuming sectors.

Meanwhile, the global commodity market intelligence consultancy Genscape (Louisville, Ky.), in a webinar July 21, also pointed to record-high U.S. propane inventories and production, as well as drawing attention to record-low prices, rock-bottom percentage values compared to crude oil and ethane, the latter, like propane, a petrochemical feedstock, in addition to record basement prices for American propane versus international valuations.

RBN’s Rusty Braziel and Ron Gist highlighted that U.S. propane production has more than doubled, and new production is closer to major market areas such as the Northeast and Midwest, “right where we want it to be,” observed Braziel, adding that 14 new projects currently under way are creating a “giant funnel to Mont Belvieu.” In addition, a significant number of new rail facilities are coming online, and new pipeline, storage, export, and rail infrastructure equates to a more interconnected market. And while that interconnectivity is positive, RBN cautioned that regional markets would therefore see more significant impacts from disruptions in other regions. Braziel and Gist also advised that rail transportation is less ratable than pipeline deliveries; manifest shipments are not a priority for railroads, calling into question just-in-time reliability.

Moreover, during the 2015-2018 timeframe, if all planned U.S. natural gas processing expansions are built and fully utilized, an additional 200,000 bbld, or about 3 Bgal., of propane will be added to the supply mix. Further, fractionator expansion projects promise to add 1,050,000 bbld of capacity over the same period.Among the proposed pipeline projects being considered is Enterprise Products’ (Houston) Marcellus connector initiative, RBN reported, which would connect the top ends of the TEPPCO and MAPL bidirectional propane systems. Enterprise comments that only 150 miles separate TEPPCO and MAPL, and linking the systems would allow 40,000 to 60,000 bbld of Marcellus/Utica propane to access the Midwest, Conway, and Mont Belvieu markets. Enterprise’s 2.1 MMbbl of propane storage in the Northeast would provide additional flexibility for the proposed takeaway project.

At the same time, RBN said rail utilization for some major propane retailers has climbed 10% to 20% over the past two years. There are about 55,500 pressure cars with 30,000-gal. capacity in the fleet, based on June data from the American Association of Railroads. Estimates have 50% in LPG service, of which 75% are in propane service. Railcars are used in propane service 60% of the year, but are full only 50% of the time, implying 187 MMgal., or 4 MMbbl, of propane are in rolling storage, RBN said, adding that an estimated 88,000 carloads of propane have moved this year. Rail terminal storage, meanwhile, was set at 1.1 MMbbl, or 46 MMgal. The disbursement of those gallons includes 10.5 MMgal. in the Northeast, 14.7 MMgal. in the Midwest, 15.8 MMgal. in the Gulf Coast, 0.6 MMgal. in the Rocky Mountain Region, and 4.2 MMgal. on the West Coast.

RBN added that primary propane storage capacity is at 136 MMbbl, or 5.7 Bgal., with the majority of that in PADD 3, the Gulf Coast, and PADD 2, the Midwest. The consultancy pegged residential propane tank storage capacity—households using propane for space heating, water heating, and cooking—at 132 MMbbl, or 6.4 Bgal. Of that, 1.5 Bgal. are in the Northeast, 2.5 Bgal. in the Midwest, 1.0 Bgal. in the Gulf Coast, 0.8 Bgal. in the Rocky Mountain region, and 0.5 Bgal. on the West Coast.

Turning to the propane export market, Braziel and Gist noted that capacity stands at 1.2 MMbbld now, and soon could grow to 1.5 MMbbld. In July, a reported 700,000 bbld left from the Gulf Coast alone. They added that most LPG export contracts are not affected by seasonal demand since they are with year-round end users such as ethylene crackers, propane dehydrogenation (PDH) plants, cooking and autogas buyers, and power generators. The most dramatic change in LPG exports will occur in mid-2016 with the opening of the Panama Canal expansion. This will allow the entire global very large gas carrier (VLGC) fleet to transit the canal for voyages to the Far East. Currently, only specialized Panamax vessels can pass.

Emerging production and product flow shifts are also favorable. In its forecast, RBN established contrasting contraction and growth scenarios. Contraction assumes a continued low commodity price environment, while growth is based on a more robust market. That growth scenario sees resilient production keeping volumes growing; West Texas Intermediate (WTI) crude oil, the U.S. benchmark, returns to the $80/bbl range by 2017 and $95/bbl by 2020. Contraction means the scenario is still resilient, and some production totals see 2014-2015 year-over-year growth, but production declines begin in 2016. WTI prices average $50/bbl in 2015 and only reach $65/bbl by 2020. Short hand: production increases will be largely based on U.S. benchmark oil prices; when crude is priced higher, producers drill more, and the higher the price, the more NGLs are recovered. Conversely, low oil prices weigh on all drilling activities, both gas and crude.

Under those opposing views, by 2020, propane production on the East Coast — Marcellus/Utica — would increase to between 200,000 bbld (contraction) and 300,000 bbld (growth) — to 3 to 4.6 Bgal. a year, respectively. Regardless of ei ther scenario, traditional inbound flows on TEPPCO from the Gulf Coast and by rail from various supply points will be displaced by local production moving on rail and the north end of TEPPCO. Rail from local fractionation facilities will make up a larger portion of supply. Some winter inbound flows on TEPPCO will continue to make up for storage capacity shortfalls. The region will also see new demand from a new PDH unit at Sunoco Logistics’ Marcus Hook, Pa. industrial complex, as well as waterborne exports from Marcus Hook.

Propane production in the Midwest region is seen as increasing to between 425,000 bbld and 500,000 bbld to reach 6.5 to 7.7 Bgal. a year over the period, depending on contraction or growth. Additional production is primarily centered in North Dakota’s Bakken formation, with barrels from Canada and Oklahoma contributing. New rail facilities replace Cochin pipeline deliveries.

By 2020, RBN expects propane production in the Gulf Coast to rise to between 975,000 bbld and 1.1 MMbbld and stand from 15 Bgal. to 17 Bgal. a year. Production growth within the region and flows from the Midwest will move mostly to exports, with some demand increases from new PDH plants. In the Rocky Mountain region, production is forecast to increase to between 130,000 bbld and 140,000 bbld and stretch to 2 Bgal. to 2.2 Bgal. a year. Most production gains will move to the Midwest via pipeline. Finally, the West Coast remains virtually unchanged at 65,000 bbld, or 1 Bgal. a year. Some small-volume propane exports will leave the U.S. from Ferndale, Wash.

Prices

Braziel and Gist underscored that propane prices are determined by fundamentals —the interaction of supply (production, imports, inventory levels) —and demand (weather, petrochemical usage, and exports). “The most significant correlation to propane prices is the price of crude oil due to propane’s competition with other petrochemical feedstocks that vary with crude oil, and the production of propane from crude oil refineries.” Although below 30% recently, propane’s value as a percentage has averaged 44% of WTI since 2012. Changes in that percentage are determined, primarily, by the supply/demand balance of propane.

Therefore, propane prices will be higher in RBN’s growth scenario due to higher crude prices. Although prices will be lower in the contraction outlook, the ratio to crude will be higher due to a tighter supply/demand balance. “This tightness results from lower propane production, but a strong pull on export volumes due to ‘sunk cost’ investments in terminals and ships.” In other words, such investments are contracted in advance. Costs are entrenched — sunk. Further, lower U.S. propane prices sustain the attraction for exports since shipments offshore depend on a discount to world prices that is still low enough when shipping costs are added. When U.S. and international prices balance, exports decline.

Concluding, RBN views production growth adjacent to, and within, the Northeast demand region leading to even more shifts for supply to local sources. A higher proportion of supply will be delivered by rail, but Dixie Pipeline and TEPPCO will continue to be important sources. Overall, TEPPCO volumes will be boosted by Marcellus/Utica production. Therefore, retailers should focus on local supplies for ratable volumes, supplemented by seasonal purchases from pipeline, rail, and local storage. However, the intermittent nature of rail deliveries will require more planning and scheduling to avoid supply disruptions.

In the Upper Midwest, propane will increasingly be supplied by Bakken and other Midwest production, with much of it delivered by rail. Retailers previously served by the Cochin pipeline or by new rail terminals will need to plan for more intermittent deliveries. Marketers served from the MAPL or Oneok systems can continue to rely on consistent deliveries from those sources. It’s business as usual, RBN said.

The consultancy advised both Northeast and Midwest retail suppliers to carefully monitor export volumes. Gulf Coast exports “have become a huge gateway to the global propane market,” and “pricing in global markets will increasingly impact pricing in U.S. markets — and vice versa.” Supplies to meet Gulf Coast export commitments, however, will come from production within the region, but with significant receipts of Midwest and Rocky Mountain production. As well, additional demand is coming for new PDH units in the Gulf.

“With increasing production near demand regions, better connectivity from both pipeline and rail, and export volumes that can be bid away from global markets, the U.S. propane industry is in a much better position to handle a perfect storm of events than it was in the winter of 2013-2014,” RBN asserted. “But all supply is local. Retailers must continue to diligently prepare for short-term market events that can disrupt the supply chain. Through careful planning, operational best practices, and prudent contracting, the retail propane industry is in an excellent position to navigate the uncertain waters of today’s energy markets.”

Breaking Even

Bob Simmons, Genscape’s production manager, NGLs, observed during the consultancy’s late-July webinar that production breakeven values have decreased since October 2014, leading to a reduction in rig counts. Although producers are focusing their efforts in core play areas, leading to an increase in NGL gallons per Mcf of natural gas processed, weak commodity prices, including NGLs, are contributing to lower breakeven prices. Active rigs have decreased 60% from the October 2014 peak, and all regions have been impacted, although the Northeast region has had the lowest reduction. Simmons said June appears to have been the bottom of the fall, since in July rig counts climbed and are forecast to rise further in the current price environment. However, rig counts are seen falling again in 2016.

In addition, Genscape sees natural gas and crude oil production peaking this summer, with reduced drilling, deferred well completions, and natural declines leading to lower production in 2016. Within this landscape, right now gas plant production of propane and butane per Mcf of natural gas processed is increasing, which relates to producers focusing efforts in the core acreage of liquids-rich shale plays. Future results call for flat to growing production of those liquids, while natural gas production is expected to decline.

Simmons’ outlook calls for lower-48 propane production in the upcoming winter to be flat versus summer 2015, although growth continues to occur in the Northeast. Though PADD 3, mainly Texas, growth has been robust from this past spring, Genscape expects that growth to slow down over the second half of this year. Nonetheless, producers continue to complete more wells than expected, leading to increased natural gas growth in core acreage with high gallons of NGLs recovered per thousand cu ft (GPM). Operating rates at new natural gas processing plants are estimated to be greater than 85%, and an additional 5 Bcfd of capacity is scheduled to come online between now and the end of this winter.

Addressing petrochemical demand, Amanda Townsley, senior advisor, NGLs, for Genscape noted that propane and butane remain competitively advantaged versus ethane for cracking. Cracking operating rates have been strong, with low levels of planned outages. Propane demand for cracking should increase, but concerns regarding propylene oversupply and wintertime spikes remain. In addition, new PDH demand coming online will soon add 30,000 bbld to 35,000 bbld on top of present cracking demand for propane. Petrochemical users, depending on price, may prefer propane to ethane. On a volumetric basis, propane yields 17% propylene compared to 3% for ethane, she said.

Genscape compared propane exports to the 800-lb gorilla in the room. Those shipments are expected to increase due to the growing VLGC fleet and cheaper and available freight. “From 35 to 40 boats will be commissioned this year, with another 40 to 50 vessels arriving next year,” she said. “Compare that with only eight new vessels in 2014.” As well, new export terminal capacity will contribute — 7 MMbbl a month is coming online by the end of this year —and it’s fully contracted. Townsley commented that she expects exports to continue leaving U.S. shores at a 700,000-bbld rate throughout the upcoming U.S. winter demand season.

Genscape summarizes that, “though starting off demand season at record-high inventories, lack of growth in supply plus new export capacity provide the likelihood for above-average rates of draw for propane and butane.” Butane and propane are currently priced out the forward curve for maximum cracking, although butane may not be targeted as much.

Although Far East propane versus Mont Belvieu is backward going into 2016, freight rates will likely adjust to encourage continued exports, although capacity will likely be underutilized. And assuming normal weather in winter 2015-2016, propane inventories should retrace close to the historical average by the end of the heating season, drawing 20 MMbbl more than last year, “the material chunk of the overhang,” according to Townsley.

So, the outlook is bullish, right? Genscape responds: Well, sort of. “We believe that butane and propane have the potential to appreciate as they normally do seasonally. However, upside versus other energy is limited by the continued need for LPG to price for economically sensitive demand — if not domestically, then internationally. Any large changes in LPG flat price during demand season are likely to be driven by external forces, e.g., crude pricing or potentially extreme global weather.”

Bullish: production growth is slowing at this price deck; lower pricing is supporting demand growth for cracking and consumption; new capacity and ships are yielding higher exports; and the demand season is approaching. Bearish: Unless exceptional weather or demand requires competitive pricing, the upside is capped.

Crop Drying/Weather

Josh Senechal, a member of Genscape’s meteorology team, commented that the Corn Belt so far this year has experienced relatively cool weather, with no significant heat. “Below-normal temperatures have persistently impacted the Midwest, with more appreciable warmth limited to the southeastern and western U.S.,” he said. But heavy rainfall has impacted the eastern two-thirds of the Corn Belt, resulting in high surface moisture content.” There’s been a wet June, but a drier July. Grain dry-down needs are seen to be high this season, but not off the charts as in the lead-up to winter 2013-2014.

Heading into August, Senechal forecasts cooler temperatures, and with the early corn planting, crop maturity is expected to be normal. The combination of heavy rainfall across portions of the Midwest and a general lack of heat into fall suggests strong usage of propane for crop drying. In addition, wet risks during September across the southern Midwest suggests the presence of excess grain moisture for nearly 50% of major growing areas. Dry-down needs will be lowest across the western and Upper Midwest where conditions will be drier, he predicted.

Senechal added that the El Niño oscillation is expected to be the primary forecast driver heading into the winter months. Moderate to strong El Niño conditions are currently in place and are expected to persist through the winter months. The result, warmer weather across the northern half of the U.S., and bearish propane demand there.

He highlighted that 1957-1958, 1987-1988, and 1997-1998 stand out as the top-three winter analog years for El Niño due to the presence of moderate to strong conditions. Comparing those years suggests broad coverage of above-normal temperatures across the northern half of the U.S., with below-normal temperatures across the South. “This should result in below-normal propane demand with weaker demand in comparison with last winter,” Genscape’s meteorology team member said.

The consultancy maintains that, historically, U.S. crop-drying demand has held a wide range from about 1 MMbbl to 9 MMbbl during October and early November. Last year, demand was listed at about 3 MMbbl. This year that total is likely to be more than the minimum, but not above last year.

Weighing in on heating demand, Genscape characterized the draw varying by as much as 40 MMbbl between a warmer versus a cold winter, with last winter being a bit colder than normal, but nothing compared to the previous heating season, which was exceptionally, and enduringly, frosty. Year-over-year, the forecast for this winter compared to last, according to Genscape, is expected to be lighter by 4 MMbbl for propane, although affordability may prompt some households to burn additional gallons to stay extra toasty.

Augmenting the webinar discussion, in a white paper it published in July, Genscape framed the “delicately balanced” natural gas liquids supply chain that has emerged recently in the U.S. Northeast, where production from the prolific Marcellus and Utica gas plays has amassed the largest NGL liquid reserves in the U.S. The paper spotlighted that production growth has sparked a wave of new infrastructure to gather, extract, and process NGLs in the region, an area previously lacking in such infrastructure. And in turn, Marcellus and Utica natural gas production has become dependent on the continuous operation of each infrastructure node, meaning disruptions can have a large ripple effect across the entire system.

“The deep connectivity of gas production to NGL processing and transportation infrastructure is unprecedented, and insight into real-time fractionation and NGL pipeline operations provide upstream and downstream market participants with critical, price-sensitive information,” the consultancy said, referencing monitoring services it provides.

Noted was that the Marcellus and Utica natural gas plays have an estimated 1 MMbbld of raw NGL potential. Production growth in the plays has increased steadily since the end of 2012, growing from 45,000 bbld to 392,000 bbld this year. NGL production in the NGL-rich gas shale plays is expected to continue to grow, while the growth rate is slowing elsewhere in the U.S. The Northeast is forecast to grow by 75%, or by 168,000 bbld in 2015 relative to the previous year, according to Genscape. By the end of 2016, NGL production is expected to near 600,000 bbld in the U.S. Northeast.

This rapid NGL growth has resulted in the creation of an NGL production center outside of the North American NGL hub at Mont Belvieu. But unlike Mont Belvieu, the Northeast hub is a unique NGL production center where gas production and processing is in close proximity and is tightly integrated to NGL extraction, processing, and transportation. Therefore, “a supply chain has developed that includes operational capacity for extraction of liquids, fractionation of raw NGLs to purity products, and the transport of those products to the downstream market. However, there is a lack of spare capacity inherent in this supply chain for storage and transportation, and a lack of interconnectivity between regional fractionation trains.”

Genscape comments what further complicates the delicacy of the natural gas and NGL supply chains is the high ethane content of the rich gas produced in the plays. “In general, the ethane percentage content found in raw NGL mix production is estimated to be 50% to 55% in full ethane recovery mode, 5% to 10% higher than other U.S. production areas.”

Dealing with this ethane surplus takes a multifold approach, the consultancy emphasizes. When ethane production becomes uneconomic or supply containment issues arise, ethane rejection — leaving ethane in the outlet natural gas stream — is possible and regularly takes place in the Marcellus and Utica. But, the challenge with this process is that there is a ceiling on how much is allowed due to Btu limits on natural gas pipelines. These Btu limits can restrict additional blending of ethane into natural gas when operational issues arise downstream, resulting in supply containment issues. Shutdowns at de-ethanizers (fractionation trains) downstream, and pipeline issues can all result in an excess of raw NGL and/or purity ethane supply in the Northeast.

Beyond structural ethane limits, a lack of storage capacity and the reliance on rail systems for propane-plus takeaway also leaves the Northeast vulnerable to operational issues. In processing centers like Mont Belvieu and Conway, Kan., the locus of raw NGL production is located away from the hubs. Any disruptions in fractionation or purity pipeline operations are managed with storage capacity, as feedstocks or end-product can be stored if they are in surplus due to operational issues.

Conversely, in the Marcellus and Utica, the landscape is vastly different. Genscape underscores that production is located in close proximity to downstream NGL infrastructure. Unlike Mont Belvieu and Conway, storage for raw NGL and purity products is limited in the Northeast. When purity pipelines slow, as experienced with Sunoco’s Mariner East Pipeline in February, or fractionation trains go offline, the effect is felt all the way to the gas wellhead. “Without storage capacity, NGL production, be it purity product or raw NGL mix from gas processing, must decline in the Marcellus and Utica,” Genscape maintains. “There are two ways this can be accomplished. The first option is to leave as much ethane as possible in the gas stream. But the Btu limits set a ceiling for this type of ethane ‘demand.’ And this is de facto storage for ethane, a relief valve. Once ethane is blended into the outlet as stream, ethane recovery from gas is logistically impossible. The second option, a decline in gas processing rates, ultimately leads to reductions in wellhead natural gas production. Declines in gas processing rates create an upstream bottleneck between the wellhead and the gas plant, and the relief valve is curbing-in gas production.”

The lack of storage, be it physical storage or ethane rejection capabilities, along with a lack of spare processing and transportation capacity in the Marcellus and Utica plays, leaves the NGL supply chain vulnerable to operational disruptions. This delicate balance relies on all nodes of the supply chain to work at the same time. Any disruptions, be they upstream or downstream, have a pronounced effect on price due to the frailty of these fundamentals.

Genscape adds that Marcellus and Utica purity products have diversified demand outlets. Enterprise’s ATEX pipeline connects the region to the Gulf Coast ethane market, but Mariner East and Mariner West also take ethane — and propane in the case of Mariner East — to international markets. In addition, there is potentially new regional demand for purity NGLs from Appalachian crackers or PDH units.

Separate Spots

The consultancy presses that factors, including the inherent delicacy of the Marcellus/Utica supply chain, beg the need for separate spot pricing in the Northeast —independent of Mont Belvieu. “The regional fundamentals are mostly independent of what happens at Mont Belvieu,” Genscape contends. “As such, this increases the basis risk for Marcellus/Utica purity NGLs versus the Mont Belvieu pricing hub. However, emerging spot markets take time to develop, especially with new production, infrastructure, and transportation linked to long-term supply contracts.” —John Needham