Saturday, February 6, 2016

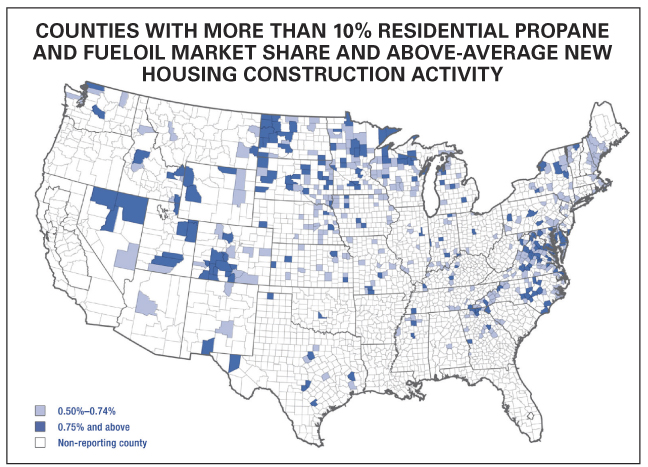

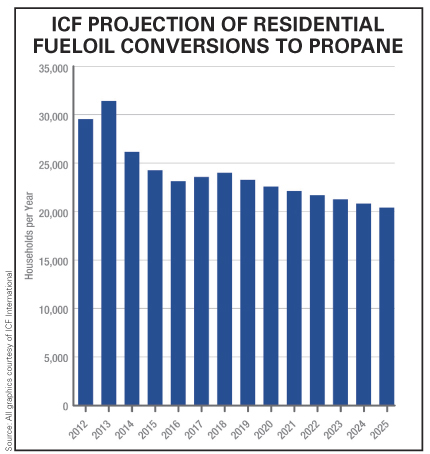

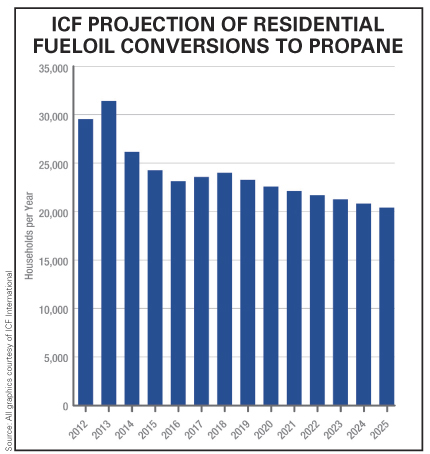

The residential fueloil market in the U.S. is larger than the residential propane market, reports ICF International’s “2016 Propane Market Outlook,” with a reported 6.2 million households using the fuel for primary space heating in 2014 while 5.9 million used propane. However, nearly 240,000 homes convert from fueloil space heating each year. The majority switch to natural gas and electricity, but about 30,000 convert to propane. Moreover, in the past few years the propane industry has gained about the same number of customers from fueloil conversions every year as it has from new residential construction.

Drivers affecting the fueloil market vary by state, but the main factors are duplicative: relatively high prices for fueloil compared to other fuels and increasing costs associated with the fuel’s environmental impact. And while future fueloil conversions to propane are expected to gradually decline as the fueloil market continues to contract, conversions should continue to yield a significant number of new propane customers for the foreseeable future, notes ICF. With a significant built-in base of consumers, fueloil presents an attractive target for conversions to propane, “with a good share of the consumers motivated to switch, and the vast majority of the households located in regions where electricity is relegated to a third-tier option for space heating.”

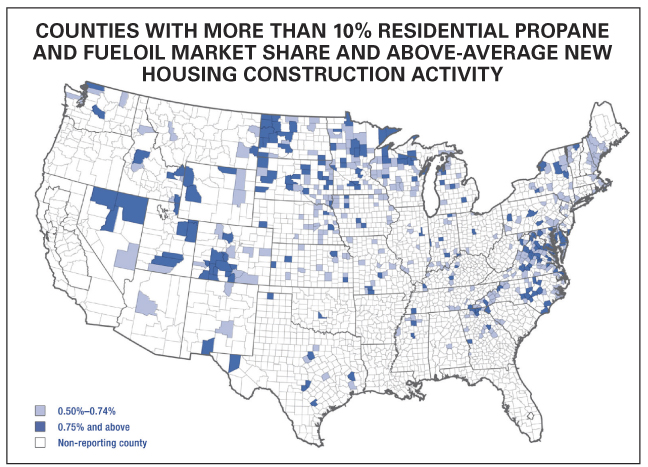

While the ongoing decline in oil prices has reduced the economic pressure to switch away from fueloil, potentially slowing conversions to propane in the near term, in the longer term ICF expects conversions to provide a continuing source of new propane space heating customers. The vast majority of existing fueloil households are located in the Northeast and Mid-Atlantic regions, and a few areas in the Midwest and Pacific Northwest. Less than 2% of homes outside the Northeast use fueloil as their primary space heating fuel, according to the Energy Information Administration. Further, the fueloil market has been declining rapidly for the last several years. Between 2008 and 2014, the number of such households decreased by more than 1.7 million, or 22%, from 7.9 million.

Another conversion opportunity exists for water heating. ICF reports that about 2.75 million households that already have propane space heating do not use the fuel for water heating, providing an opportunity to increase the number of home propane applications and grow sales. The consultancy estimates that adding water heating to existing propane space heating customers could add as much as 342 million gallons to residential sales each year. While adding propane water heating to all space heating customers is unrealistic, converting only 5% a year would add 17 million gallons annually to residential sales.

In addition, market conditions are favorable for conversions. The implementation of new water heater efficiency standards has increased the cost and complexity of replacing existing units, particularly in the larger sizes, while the decline in propane prices has improved the economics of using propane instead of electricity. Changes in the marketplace that make propane water heating more attractive to existing propane customers also make propane water heating more attractive to homes that are currently all-electric, particularly in areas of the country with high electricity prices. Larger and higher-value homes that would otherwise need to install new heat pump water heaters under the new efficiency standards are expected to provide a significant market for propane water heater conversions.

Commercial Sales

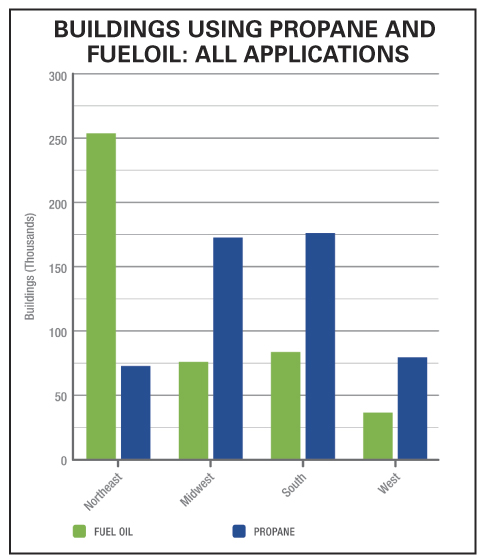

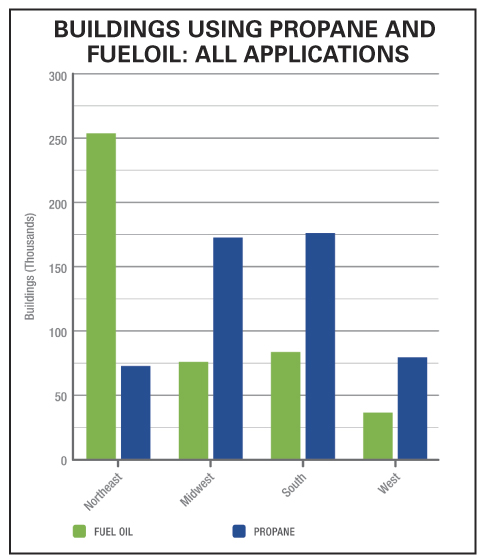

Meanwhile, in the commercial sector the conversion of fueloil heating customers, similar to the residential sector, provides yet more opportunities. Fueloil dominates the commercial heating market in the Northeast, but market share in new commercial construction has declined substantially because of permitting issues with fueloil storage tanks. While fueloil use is not as dominant in the Midwest and western regions, there remain significant pockets of use that provide potential growth for propane.

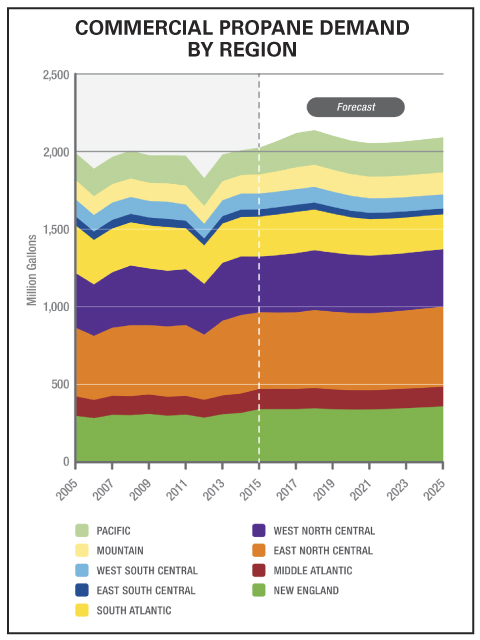

ICF observes that the commercial sector is a diverse market with a much wider range of customer types and end-uses than other sectors. The market also differs by region, in a manner similar to the residential sector. Research by the Propane Education & Research Council indicates there is significant opportunity to expand sales. Understanding regional differences in fuel use and the variety of commercial propane market segments—schools, fast food restaurants, and houses of worship—can lead to new sales opportunities.

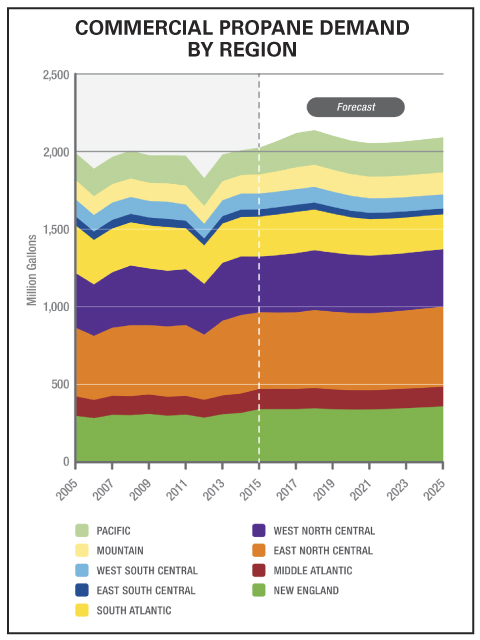

Commercial sales account for about 22% of the overall consumer propane market. The near-term forecast for propane demand shows stable, non-weather-driven consumption, with the impact of modest economic growth offset by the long-term expectation for improvements in building shell and appliance efficiency. Demand declined in 2011 and 2012 due to warmer-than-normal temperatures, but rebounded significantly in 2013 and 2014. Those gains are projected to be followed by steady demand levels through 2025 linked to gradual growth in commercial activity.

Yet another commercial sector market opportunity seen in the “2016 Propane Market Outlook” is promotion of tankless water heaters in a variety of segments, including the lodging and resort industry and in institutional and educational settings. The report comments that, in the commercial sector, tankless water heating can have both up-front and operating-cost advantages relative to electric water heating when electric-system cost savings and building space savings are fully accounted for.

Challenges, Opportunities

Overall, ICF asserts that achieving sustained propane sales growth depends on the industry’s success in responding to the leading market challenges and opportunities likely to be faced in the next few years. Key challenges and opportunities include ensuring supply reliability, maintaining current markets, understanding and taking advantage of regional market segmentation, capitalizing on the propane price advantage, and participating in the national energy and environmental policy dialogue and regulatory process.

Growth in U.S. propane production is expected to provide significant benefits to American consumers—lower annual average prices across all markets—but changes in production and demand patterns for natural gas, natural gas liquids, and other liquids is nonetheless leading to infrastructure constraints in several regions of the country. The flexibility of the existing storage and transportation system to meet unexpected and peak winter supply requirements has been substantially curtailed, ICF emphasizes. Propane marketers, particularly in the Midwest and Northeast, will be less able to count on the availability of excess pipeline and storage capacity to help meet unheralded changes in propane requirements.

The consultancy adds that while the market is likely to support development of new storage facilities such as the Crestwood Finger Lakes facility in Upstate New York and the Magnum storage in Arizona, public opposition to the Finger Lakes proposal illustrates the difficulty to bring additional infrastructure online. In addition, it is unlikely that new pipeline capacity will be built to support peak-period propane demand. New capacity to meet peak-period demand would only be used a few days each year and would not be needed during warmer-than-normal winters, making it difficult for propane marketers to support the new contract commitments required to build new pipelines.

As a result, ICF said it believes that propane markets will need to develop new supply practices to ensure reliability in an infrastructure-constrained market. Such recommended practices could include additions to local storage capacity, increases in the percentage of supply purchased on a firm basis, additions of long-haul truck transport capacity, additional commitments for rail transport, increased reliance on price and supply hedging arrangements, and growth in summer load to reduce demand seasonality.

ICF adds that maintaining current market share in the residential and commercial sectors, which represent more than 70% of total consumer propane sales, will remain one of the biggest challenges facing the industry through the end of the decade. While noting that residential and commercial offer growth opportunities, both in increasing market share for existing applications—conversion of fueloil to propane—and commercialization of new technologies such as residential tankless water heaters, portable and backup generators, commercial propane-fired heat pumps, and combined heat and power (CHP) units—threats to the markets remain formidable.

Namely, propane use per customer has fallen substantially and is expected to continue to decline due to improvements in building and equipment efficiency. Electric heat pump technology is becoming more efficient and economical and is likely to continue to erode the propane heating market in many regions. In addition, ICF points out that, since 2000, the propane industry has lost more than 350,000 manufactured home customers due to the overall collapse of that market and to electricity inroads into the remaining new units being built. This trend is also expected to continue. Finally, natural gas supply is leading to lower natural gas prices and expansions in distribution systems that lead to conversions of propane customers to natural gas.

“Given the expected improvements in electric heating technology, and the expected promotion of electricity as a ‘green’ energy source by the electric power industry, maintaining existing propane customers is likely to remain challenging in many markets,” says ICF. “Preserving the current customer base will require an aggressive and coordinated effort by the propane industry. The major propane applications in these sectors have significant non-cost advantages over competing fuels and technologies: warmer heat output and the convenience of gas add value for customers. The propane industry will need to emphasize this value proposition to capture high-opportunity markets and offset inevitable losses in markets that are driven entirely by cost rather than value.”

However, the recent decline in propane prices provides the industry with a window of opportunity to effectively address these issues and to regain some of the market lost due to higher propane prices in the last five years. At the same time, it is not clear that potential customers will recognize propane’s operating cost advantage. Encouraging fueloil heating customers to invest in new, more efficient propane furnaces will require the propane industry to make a compelling case for long-term consumer benefits. Inducing customers to switch fuels may also require facilitating equipment conversions with up-front financing and other steps to simplify the process.

Finally, to ensure decision-makers in the national energy and environmental policy debate recognize propane’s emissions and supply benefits the propane industry needs to be actively involved in the federal and state policy dialogue. Federal and state policy decisions, along with the resulting tax policies and regulations on energy use, are going to play a significant role in either promoting or inhibiting propane use in a variety of markets. Through the industry’s companies and trade associations, the propane industry must engage policymakers in regulatory discussions to make sure propane is adequately considered when new energy policies are drafted.

Drivers affecting the fueloil market vary by state, but the main factors are duplicative: relatively high prices for fueloil compared to other fuels and increasing costs associated with the fuel’s environmental impact. And while future fueloil conversions to propane are expected to gradually decline as the fueloil market continues to contract, conversions should continue to yield a significant number of new propane customers for the foreseeable future, notes ICF. With a significant built-in base of consumers, fueloil presents an attractive target for conversions to propane, “with a good share of the consumers motivated to switch, and the vast majority of the households located in regions where electricity is relegated to a third-tier option for space heating.”

While the ongoing decline in oil prices has reduced the economic pressure to switch away from fueloil, potentially slowing conversions to propane in the near term, in the longer term ICF expects conversions to provide a continuing source of new propane space heating customers. The vast majority of existing fueloil households are located in the Northeast and Mid-Atlantic regions, and a few areas in the Midwest and Pacific Northwest. Less than 2% of homes outside the Northeast use fueloil as their primary space heating fuel, according to the Energy Information Administration. Further, the fueloil market has been declining rapidly for the last several years. Between 2008 and 2014, the number of such households decreased by more than 1.7 million, or 22%, from 7.9 million.

Another conversion opportunity exists for water heating. ICF reports that about 2.75 million households that already have propane space heating do not use the fuel for water heating, providing an opportunity to increase the number of home propane applications and grow sales. The consultancy estimates that adding water heating to existing propane space heating customers could add as much as 342 million gallons to residential sales each year. While adding propane water heating to all space heating customers is unrealistic, converting only 5% a year would add 17 million gallons annually to residential sales.

In addition, market conditions are favorable for conversions. The implementation of new water heater efficiency standards has increased the cost and complexity of replacing existing units, particularly in the larger sizes, while the decline in propane prices has improved the economics of using propane instead of electricity. Changes in the marketplace that make propane water heating more attractive to existing propane customers also make propane water heating more attractive to homes that are currently all-electric, particularly in areas of the country with high electricity prices. Larger and higher-value homes that would otherwise need to install new heat pump water heaters under the new efficiency standards are expected to provide a significant market for propane water heater conversions.

Commercial Sales

Meanwhile, in the commercial sector the conversion of fueloil heating customers, similar to the residential sector, provides yet more opportunities. Fueloil dominates the commercial heating market in the Northeast, but market share in new commercial construction has declined substantially because of permitting issues with fueloil storage tanks. While fueloil use is not as dominant in the Midwest and western regions, there remain significant pockets of use that provide potential growth for propane.

ICF observes that the commercial sector is a diverse market with a much wider range of customer types and end-uses than other sectors. The market also differs by region, in a manner similar to the residential sector. Research by the Propane Education & Research Council indicates there is significant opportunity to expand sales. Understanding regional differences in fuel use and the variety of commercial propane market segments—schools, fast food restaurants, and houses of worship—can lead to new sales opportunities.

Commercial sales account for about 22% of the overall consumer propane market. The near-term forecast for propane demand shows stable, non-weather-driven consumption, with the impact of modest economic growth offset by the long-term expectation for improvements in building shell and appliance efficiency. Demand declined in 2011 and 2012 due to warmer-than-normal temperatures, but rebounded significantly in 2013 and 2014. Those gains are projected to be followed by steady demand levels through 2025 linked to gradual growth in commercial activity.

Yet another commercial sector market opportunity seen in the “2016 Propane Market Outlook” is promotion of tankless water heaters in a variety of segments, including the lodging and resort industry and in institutional and educational settings. The report comments that, in the commercial sector, tankless water heating can have both up-front and operating-cost advantages relative to electric water heating when electric-system cost savings and building space savings are fully accounted for.

Challenges, Opportunities

Overall, ICF asserts that achieving sustained propane sales growth depends on the industry’s success in responding to the leading market challenges and opportunities likely to be faced in the next few years. Key challenges and opportunities include ensuring supply reliability, maintaining current markets, understanding and taking advantage of regional market segmentation, capitalizing on the propane price advantage, and participating in the national energy and environmental policy dialogue and regulatory process.

Growth in U.S. propane production is expected to provide significant benefits to American consumers—lower annual average prices across all markets—but changes in production and demand patterns for natural gas, natural gas liquids, and other liquids is nonetheless leading to infrastructure constraints in several regions of the country. The flexibility of the existing storage and transportation system to meet unexpected and peak winter supply requirements has been substantially curtailed, ICF emphasizes. Propane marketers, particularly in the Midwest and Northeast, will be less able to count on the availability of excess pipeline and storage capacity to help meet unheralded changes in propane requirements.

The consultancy adds that while the market is likely to support development of new storage facilities such as the Crestwood Finger Lakes facility in Upstate New York and the Magnum storage in Arizona, public opposition to the Finger Lakes proposal illustrates the difficulty to bring additional infrastructure online. In addition, it is unlikely that new pipeline capacity will be built to support peak-period propane demand. New capacity to meet peak-period demand would only be used a few days each year and would not be needed during warmer-than-normal winters, making it difficult for propane marketers to support the new contract commitments required to build new pipelines.

As a result, ICF said it believes that propane markets will need to develop new supply practices to ensure reliability in an infrastructure-constrained market. Such recommended practices could include additions to local storage capacity, increases in the percentage of supply purchased on a firm basis, additions of long-haul truck transport capacity, additional commitments for rail transport, increased reliance on price and supply hedging arrangements, and growth in summer load to reduce demand seasonality.

ICF adds that maintaining current market share in the residential and commercial sectors, which represent more than 70% of total consumer propane sales, will remain one of the biggest challenges facing the industry through the end of the decade. While noting that residential and commercial offer growth opportunities, both in increasing market share for existing applications—conversion of fueloil to propane—and commercialization of new technologies such as residential tankless water heaters, portable and backup generators, commercial propane-fired heat pumps, and combined heat and power (CHP) units—threats to the markets remain formidable.

Namely, propane use per customer has fallen substantially and is expected to continue to decline due to improvements in building and equipment efficiency. Electric heat pump technology is becoming more efficient and economical and is likely to continue to erode the propane heating market in many regions. In addition, ICF points out that, since 2000, the propane industry has lost more than 350,000 manufactured home customers due to the overall collapse of that market and to electricity inroads into the remaining new units being built. This trend is also expected to continue. Finally, natural gas supply is leading to lower natural gas prices and expansions in distribution systems that lead to conversions of propane customers to natural gas.

“Given the expected improvements in electric heating technology, and the expected promotion of electricity as a ‘green’ energy source by the electric power industry, maintaining existing propane customers is likely to remain challenging in many markets,” says ICF. “Preserving the current customer base will require an aggressive and coordinated effort by the propane industry. The major propane applications in these sectors have significant non-cost advantages over competing fuels and technologies: warmer heat output and the convenience of gas add value for customers. The propane industry will need to emphasize this value proposition to capture high-opportunity markets and offset inevitable losses in markets that are driven entirely by cost rather than value.”

However, the recent decline in propane prices provides the industry with a window of opportunity to effectively address these issues and to regain some of the market lost due to higher propane prices in the last five years. At the same time, it is not clear that potential customers will recognize propane’s operating cost advantage. Encouraging fueloil heating customers to invest in new, more efficient propane furnaces will require the propane industry to make a compelling case for long-term consumer benefits. Inducing customers to switch fuels may also require facilitating equipment conversions with up-front financing and other steps to simplify the process.

Finally, to ensure decision-makers in the national energy and environmental policy debate recognize propane’s emissions and supply benefits the propane industry needs to be actively involved in the federal and state policy dialogue. Federal and state policy decisions, along with the resulting tax policies and regulations on energy use, are going to play a significant role in either promoting or inhibiting propane use in a variety of markets. Through the industry’s companies and trade associations, the propane industry must engage policymakers in regulatory discussions to make sure propane is adequately considered when new energy policies are drafted.