Thursday, April 7, 2016

By Pat Thornton. . . As we entered March 2016, propane inventory levels were at 63 MMbbl in the U.S. It wasn’t that long ago when we were over 100 MMbbl, and then only a couple of months into 2016 and after a lackluster winter we were only 8 MMbbl ahead of the year prior. During the first week of March, the natural gas price reached an 18-year low at $1.57/MMBtu. But by the beginning of March propane price increases had surprised a few industry members who kept seeing crude oil in the low-$30/bbl range, and thought with so much crude oil supply and Iran adding to the glut crude would just keep holding everything, including propane, down.

An uptick for propane prices while crude prices remain flat is a sign that propane is affected by fundamentals that are not factors in the crude oil market. A much larger percentage of propane in the United States comes from natural gas than a few years ago. While it used to be 50/50 with crude oil, natural gas is the source of well over 75% of propane produced in the U.S. now. Nothing cures low prices like low prices, and low values for natural gas are curtailing production. Less natural gas means less propane, and the best solution is higher prices. It is currently very difficult to raise the capital needed to reverse the decline in drilling and production, and these lower levels will likely boost propane prices.

With prices very low for locking in for the next couple of years in the future, it makes sense to position a large percentage of propane needs. It is a good time to talk to commercial end-users who love their cost of goods at current levels, versus what they have seen in the past few years. For the commercial buyer, locking in propane at these levels can guarantee strong margins and profits for as far out as they can lock in the propane price. In addition to the obvious concerns of prices going up due to slowing natural gas production, here are a couple other factors you can mention to large commercial users that can affect the price of propane in the next few years.

As many Americans enjoy gasoline retail prices near $2 a gallon and propane customers across the country enjoy a break on their home heating bills, it seems the record levels of oil and gas inventories have provided one of the few positives for family budgets across the U.S lately. The idea that Saudi Arabia, Russia, and many other countries are producing more crude oil than ever and competing for market share is music to the ears of consumers, who are glad to take advantage of savings wherever they can.

With three billion barrels of oil in storage and countries around the world continuing to produce 2 MMbbld more than is needed to meet world demand, the glut of crude oil has certainly been putting a lot of pressure on the price of oil. Crude oil has fallen from a high of well over $100/bbl to $30/bbl, and while this may be great news for consumers, it is a major problem for countries around the world where crude oil is one of the few, if not the only, commodity they produce and sell.

The problems caused in many of these countries have only one really good solution: crude oil prices rising back up well over $100/bbl. There is a real concern that, ultimately, we get there in the next few years and maybe sooner. Either the OPEC countries, along with others, agree to cut production or the governments of some of these nations, including Russia and Saudi Arabia, collapse in the next couple of years. In both scenarios, higher prices likely follow.

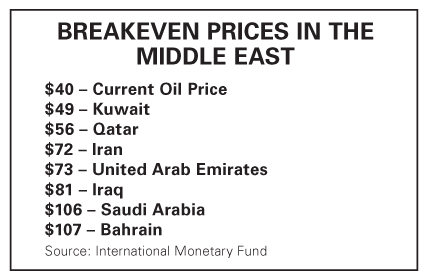

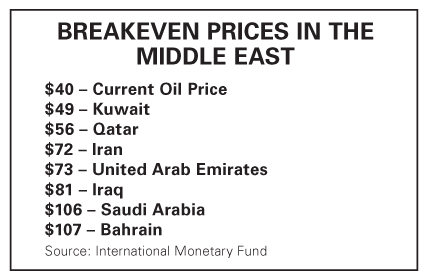

Saudi Arabia plays a major role in how we got to where we are today and where we go in the future. Crude oil is its only real commodity. With only $10/bbl in production costs, one might think the Saudis would have no worries. But the Saudis need to sell oil at around $106/bbl to balance their budget, according to International Monetary Fund (IMF) estimates. With nearly $700 billion in reserve, Saudi Arabia could survive another five years with $50/bbl crude oil, but they are running through those reserves fast. They are making major moves to preserve cash, having raised $4 billion selling bonds earlier this year and taking $70 billion from asset management firms such as BlackRock in the past nine months.

While the IMF has warned Saudi Arabia it needs to drastically cut its budget, it can’t easily afford to. In response to the Arab Spring uprising in 2011, Saudi Arabia added $130 billion into the economy, raising wages, improving services, and providing jobs for its growing population. With the youngest population in the Middle East, 25% of its population lives in poverty. Money and heavy repression diffuse unrest in the kingdom. And with those added costs, Saudi Arabia is finding that adding the price of war is very expensive with oil under $50/bbl.

In the past year, the Saudis made what they considered a strategic decision to undermine competitors by increasing their oil production and lowering the global oil price. Thinking the price of oil would merely fall from $100/bbl to $80/bbl for a few months, the plan was to strangle competitors that have more expensive production costs. With the U.S. relying on more costly hydraulic fracturing and companies exploring the Arctic, Saudi Arabia hoped to halt these competitors while also damaging other competitors like Russia, Venezuela, Ecuador, and Iran.

While the strategy did slow down the hydraulic fracturing industry, cut production from Canada’s oil sands, halt drilling in the Arctic, and create damaging economic issues for their competitors, add China’s economic slowdown to the picture and instead of a drop to $80/bbl for a few months Saudi Arabia got way more than it bargained for. In less than a year the oil price has dropped to $30/bbl with no signs of moving up dramatically anytime soon. Saudi production set a record again in October with more than 10 MMbbld of output.

With the results of ramping up production having caused problems internally and dissention among the highest ranks of the Saudi royal family, we may soon see a move within OPEC, which is largely controlled by the kingdom, to start slowing production. Certainly OPEC members Venezuela, Ecuador and Algeria, who have been pleading for cuts that would get prices back up to $75/bbl, want this new approach. The OPEC charter states that it exists to protect all members, but OPEC’s Dec. 4 meeting ended in a stalemate after much discussion and debate.

Saudi Arabia is also not immune to the havoc created by ISIS. Five ISIS-linked terrorist attacks on Saudi soil have occurred since May. As ISIS seeks to spread its campaign of terror around the globe, the geopolitical risk the group presents is barely priced into the oil market. The unrest in the Middle East, where four civil wars are under way, presents more challenges for Saudi Arabia as Russia is getting involved in challenging ISIS. With one-fifth of the world’s oil passing through the nearby Strait of Hormuz, a major disruption there could cause a quick bump up in oil prices.

For Russia, the reasons for getting involved in Syria are due to the same kinds of financial challenges Saudi Arabia faces. No one doubts it escaped the attention of Russian President Vladimir Putin that his September bombing campaign in Syria helped boost crude prices at least temporarily over $50/bbl. While his stated mission of fighting ISIS is seen as an excuse to also hit western-backed rebels who threaten Russian ally, Syrian President Bashar al-Assad, the collateral effect of getting oil prices back up plays well politically at home.

Russia has a history of using aggression to affect oil prices. In 1979, Russian tanks moved into Kabul, Afghanistan, causing oil to approach the equivalent of $110/bbl in today’s money and hurt the West’s control over supply and demand. While the Soviet plan was to keep oil prices high enough, long enough, to win the Cold War, the plan ultimately failed, bankrupting the Kremlin and causing Mikhail Gorbachev to launch Perestroika reforms that eventually brought about the fall of the old Soviet state. Nonetheless, Putin appears to want to try similar tactics to boost oil prices again.

There are a few reasons why Russian involvement in the Syrian crisis will possibly increase the price of oil in the longer term. For one, it raises the stakes with Saudi Arabia and others financing the opposition in Syria fighting the Assad regime and ISIS. In addition, the presence of Russia builds upon the conflicts in the region, where huge amounts of crude oil originate. And Russia adds strength to Saudi Arabia’s enemy, Iran, which has secured a deal to lift economic sanctions over its nuclear program. A final resolution is still being worked out.

Billionaire oilman T. Boone Pickens believes the bump up in oil prices in September was just what Putin was looking for. Putin only wishes the prices had stayed up. Pickens recently stated, “A lack of leadership in the United States has allowed Putin to walk into the Middle East and be right there.” While some don’t see the intervention in Syria as having a lasting impact, others feel it is a long-term play that could affect prices as Putin appears to stop at nothing to reach his goals. Of course, in addition to bumping up oil prices, Putin wants to deflect attention from Russian aggression in Ukraine and he wants to prevent the fall of his Syrian ally, Assad. And by challenging ISIS, he hopes to take control of as many of the terrorist group’s oil assets as he can. The more prolonged the war in the Middle East, the more likely Putin’s moves will boost oil prices.

As we entered 2016, jawboning among OPEC and non-OPEC producers continued, but little in the way of serious production cuts was achieved. Agreements to limit production to already too-high levels haven’t done much to drive prices up, especially as Iranian production has flooded the already saturated market. For now, the strategy seems bent on fighting for market share while causing production cuts in the United States. If OPEC and non-OPEC producers make some quick decisions that it is time to get serious about cutting production, crude oil and propane prices will move up accordingly.

Further, on Aug. 15, 1914, the Panama Canal moved the first cargo ship through and sent it on its way to Asia, changing forever the dynamics of global seaborne trade. Just a little over a century later, a newly expanded Panama Canal is going to once again cause major changes for seaborne trade. Larger ships that until now have had to sail all the way around the southern tip of South America will be able to traverse the canal, meaning world seaborne trade through the canal will rise from 3% to 6%, or even 7%. The $6-billion expansion, originally to have been completed by the 100-year anniversary of the canal in 2014, is running two years behind schedule. It is now 96% complete and is expected to be open in May of this year.

Any sector where the U.S. is a net exporter will likely see expansion. While the paper, raw textile, and machinery industries will likely see a modest increase in exports, some industries such as steel, cement, and fertilizer will see losses as competing countries will pay less to get their products to the U.S. Who will be the biggest beneficiaries of the expanded Panama Canal? The agriculture and natural gas sectors will benefit greatly. Among those poised to benefit the most are shippers of LNG and LPG.

Before you get too excited for the new opportunities for propane, keep in mind this change may not benefit you at all unless you happen to be fairly high up in companies such as Targa Resources Partners, Enterprise Products Partners, Ferrellgas Partners, AmeriGas Partners, Suburban Propane Partners, DCP Midstream Partners, and NGL Energy Partners. Additional exports will very likely just drive up the wholesale domestic cost for the rest of the U.S. propane industry.

The opening of the Panama Canal will allow very large gas carriers (VLGCs) to cut travel time from the U.S. Gulf to Asia from 41 days at sea to 25 days. This is a huge benefit for shippers as it brings shipping time almost even with shipping from the Middle East to Asia, making U.S. product more competitive. With record exports of 729,000 bbld—nearly 22 MMbbl a month—now, this is one more factor that will keep product flowing out of the U.S. at an even faster rate than ever before.

Keep in mind that up until 2010, the U.S. capacity to ship propane was only 4 MMbbl a month. As shale production ramped up beginning a little over 10 years ago, the price of crude oil was beginning to soar to new heights. And while propane prices moved up, they did not rise at the pace of crude oil. With all of the production increases, even with the export capacity having ramped up significantly in the past five years, we still see disparities in prices around the globe. June 2015 propane in Edmonton, Alta. was at 2 cents/gal., while U.S. Gulf Coast, Northwest Europe, and Japan propane were at 36 cents/gal., 68 cents/gal., and 96 cents/gal., respectively.

Propane continued to fluctuate up and down in tandem with crude oil changes as it still does today, but it does so at a significantly lower percentage to the crude price. When measured in gallons, propane used to be considered balanced at 75% of the price of crude oil. Lately, Mont Belvieu propane has been trading closer to 42% of crude oil priced in gallons. It has long been thought that as exports ramped up to be more in balance with the rapidly expanded U.S. production rates, propane would once again trade at a higher percentage to crude. To put it in perspective, 75% of crude at $32/bbl (76 cents/gal. in gallons) would be 57 cents/gal. With a move back up to just $50/bbl (119 cents/gal. in gallons), 75% of crude is 89 cents/gal.

The opening of the Panama Canal is just one factor to be aware of that will likely dramatically further boost exports from the U.S. Another factor is the continued rapid growth of export capacity. The small number of companies that are largely responsible for having increased our infrastructure have put billions of dollars into their projects. Enterprise Products Partners alone has just completed a new expansion phase taking export capacity to 16 MMbbl a month. Targa Resources Partners, until recently the only other operator of a major U.S. LPG export terminal, represents a little over a third of Enterprise’s capacity.

Several others, such as Phillips 66, Sunoco Logistics, and Occidental Petroleum, are building additional export facilities and all three have the advantage of a more congestion-free location well away from the busy Houston Ship Channel. In addition, Sunoco Logistics is the first with the ability to ship from the East Coast. Mariner East, a new LPG and ethane export facility on the Delaware River at Marcus Hook near Philadelphia, will help the company benefit from being able to ship a lot of the new LPG being produced in the Marcellus region. With all of the projects still under way, shipping capacity is expected to increase by an additional 40% by the end of 2017.

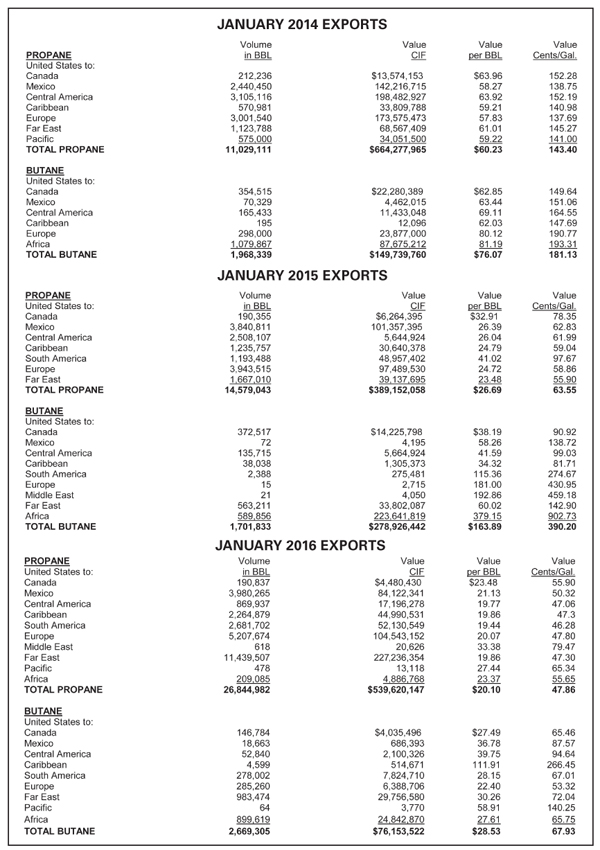

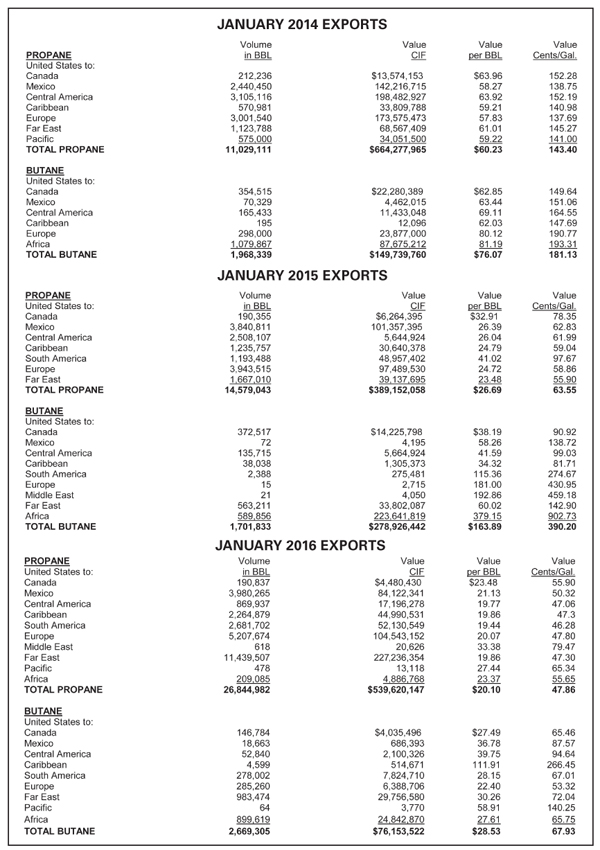

Where is all the propane going? Latin America has been a long-time importer of U.S. propane, and its demand continues to grow. European demand for U.S. exports is growing and we have seen rapid growth in Asian demand, particularly from China and India. Chinese imports almost doubled from 2013 to 2014. India’s demand has increased each month for more than two years. The U.S. should continue to gain market share in Asian countries where demand is growing, both due to increased shipping capacity and lower shipping costs. Further, China and India want the U.S. and OPEC countries to compete for their business.

An additional factor ready to facilitate exports will be lower seaborne shipping costs due to lower freight rates. With Asian countries diversifying from Middle East LPG to U.S. LPG, the need for more ships has increased dramatically. More VLGCs are being built quickly. In the meantime, the demand for these large ships has allowed freight rates to rise significantly, but as many more VLGCs are built, freight rates are expected to come down. A rapid decrease is not expected, but declines in rates are expected to be seen by mid-2016. In addition to the supply and demand of ships, costs may decline due to the increased efficiency of the newer ships. Dorian LPG, for example, says its new ships consume 17% less fuel than previous VLGCs as they have improved propulsion-system efficiency and now handle cargo more flexibly.

The question is not whether U.S. propane prices will align more closely with the world market in the future, but when. Once again, nothing cures low prices like low prices. Low prices have already caused production growth to slow in the various shale projects, and low prices have countries such as Canada also ramping up exports to Asia, with a short 12-day journey from the North American West Coast to China. Canada would rather sell product to Asia at 96 cents/gal. than to U.S. customers in a position to transport it from Edmonton for 2 cents/gal.

For the retail propane market, the question is whether waiting for another 10-cent/gal. price decline is worth the risk of a steady 30-cent/gal. gain during 2016. It may be worthwhile to go ahead and lock in more volume now while approaching customers, especially high-volume consumers, about the likely benefits of locking in low-cost volumes not only for 2016-2017, but for 2017-2018 as well.

Pat Thornton joined Mission, Kan.-based Propane Resources in 1996. He provides the Supply Division’s risk-management and supply-planning services in the east-central U.S.

An uptick for propane prices while crude prices remain flat is a sign that propane is affected by fundamentals that are not factors in the crude oil market. A much larger percentage of propane in the United States comes from natural gas than a few years ago. While it used to be 50/50 with crude oil, natural gas is the source of well over 75% of propane produced in the U.S. now. Nothing cures low prices like low prices, and low values for natural gas are curtailing production. Less natural gas means less propane, and the best solution is higher prices. It is currently very difficult to raise the capital needed to reverse the decline in drilling and production, and these lower levels will likely boost propane prices.

With prices very low for locking in for the next couple of years in the future, it makes sense to position a large percentage of propane needs. It is a good time to talk to commercial end-users who love their cost of goods at current levels, versus what they have seen in the past few years. For the commercial buyer, locking in propane at these levels can guarantee strong margins and profits for as far out as they can lock in the propane price. In addition to the obvious concerns of prices going up due to slowing natural gas production, here are a couple other factors you can mention to large commercial users that can affect the price of propane in the next few years.

As many Americans enjoy gasoline retail prices near $2 a gallon and propane customers across the country enjoy a break on their home heating bills, it seems the record levels of oil and gas inventories have provided one of the few positives for family budgets across the U.S lately. The idea that Saudi Arabia, Russia, and many other countries are producing more crude oil than ever and competing for market share is music to the ears of consumers, who are glad to take advantage of savings wherever they can.

With three billion barrels of oil in storage and countries around the world continuing to produce 2 MMbbld more than is needed to meet world demand, the glut of crude oil has certainly been putting a lot of pressure on the price of oil. Crude oil has fallen from a high of well over $100/bbl to $30/bbl, and while this may be great news for consumers, it is a major problem for countries around the world where crude oil is one of the few, if not the only, commodity they produce and sell.

The problems caused in many of these countries have only one really good solution: crude oil prices rising back up well over $100/bbl. There is a real concern that, ultimately, we get there in the next few years and maybe sooner. Either the OPEC countries, along with others, agree to cut production or the governments of some of these nations, including Russia and Saudi Arabia, collapse in the next couple of years. In both scenarios, higher prices likely follow.

Saudi Arabia plays a major role in how we got to where we are today and where we go in the future. Crude oil is its only real commodity. With only $10/bbl in production costs, one might think the Saudis would have no worries. But the Saudis need to sell oil at around $106/bbl to balance their budget, according to International Monetary Fund (IMF) estimates. With nearly $700 billion in reserve, Saudi Arabia could survive another five years with $50/bbl crude oil, but they are running through those reserves fast. They are making major moves to preserve cash, having raised $4 billion selling bonds earlier this year and taking $70 billion from asset management firms such as BlackRock in the past nine months.

While the IMF has warned Saudi Arabia it needs to drastically cut its budget, it can’t easily afford to. In response to the Arab Spring uprising in 2011, Saudi Arabia added $130 billion into the economy, raising wages, improving services, and providing jobs for its growing population. With the youngest population in the Middle East, 25% of its population lives in poverty. Money and heavy repression diffuse unrest in the kingdom. And with those added costs, Saudi Arabia is finding that adding the price of war is very expensive with oil under $50/bbl.

In the past year, the Saudis made what they considered a strategic decision to undermine competitors by increasing their oil production and lowering the global oil price. Thinking the price of oil would merely fall from $100/bbl to $80/bbl for a few months, the plan was to strangle competitors that have more expensive production costs. With the U.S. relying on more costly hydraulic fracturing and companies exploring the Arctic, Saudi Arabia hoped to halt these competitors while also damaging other competitors like Russia, Venezuela, Ecuador, and Iran.

While the strategy did slow down the hydraulic fracturing industry, cut production from Canada’s oil sands, halt drilling in the Arctic, and create damaging economic issues for their competitors, add China’s economic slowdown to the picture and instead of a drop to $80/bbl for a few months Saudi Arabia got way more than it bargained for. In less than a year the oil price has dropped to $30/bbl with no signs of moving up dramatically anytime soon. Saudi production set a record again in October with more than 10 MMbbld of output.

With the results of ramping up production having caused problems internally and dissention among the highest ranks of the Saudi royal family, we may soon see a move within OPEC, which is largely controlled by the kingdom, to start slowing production. Certainly OPEC members Venezuela, Ecuador and Algeria, who have been pleading for cuts that would get prices back up to $75/bbl, want this new approach. The OPEC charter states that it exists to protect all members, but OPEC’s Dec. 4 meeting ended in a stalemate after much discussion and debate.

Saudi Arabia is also not immune to the havoc created by ISIS. Five ISIS-linked terrorist attacks on Saudi soil have occurred since May. As ISIS seeks to spread its campaign of terror around the globe, the geopolitical risk the group presents is barely priced into the oil market. The unrest in the Middle East, where four civil wars are under way, presents more challenges for Saudi Arabia as Russia is getting involved in challenging ISIS. With one-fifth of the world’s oil passing through the nearby Strait of Hormuz, a major disruption there could cause a quick bump up in oil prices.

For Russia, the reasons for getting involved in Syria are due to the same kinds of financial challenges Saudi Arabia faces. No one doubts it escaped the attention of Russian President Vladimir Putin that his September bombing campaign in Syria helped boost crude prices at least temporarily over $50/bbl. While his stated mission of fighting ISIS is seen as an excuse to also hit western-backed rebels who threaten Russian ally, Syrian President Bashar al-Assad, the collateral effect of getting oil prices back up plays well politically at home.

Russia has a history of using aggression to affect oil prices. In 1979, Russian tanks moved into Kabul, Afghanistan, causing oil to approach the equivalent of $110/bbl in today’s money and hurt the West’s control over supply and demand. While the Soviet plan was to keep oil prices high enough, long enough, to win the Cold War, the plan ultimately failed, bankrupting the Kremlin and causing Mikhail Gorbachev to launch Perestroika reforms that eventually brought about the fall of the old Soviet state. Nonetheless, Putin appears to want to try similar tactics to boost oil prices again.

There are a few reasons why Russian involvement in the Syrian crisis will possibly increase the price of oil in the longer term. For one, it raises the stakes with Saudi Arabia and others financing the opposition in Syria fighting the Assad regime and ISIS. In addition, the presence of Russia builds upon the conflicts in the region, where huge amounts of crude oil originate. And Russia adds strength to Saudi Arabia’s enemy, Iran, which has secured a deal to lift economic sanctions over its nuclear program. A final resolution is still being worked out.

Billionaire oilman T. Boone Pickens believes the bump up in oil prices in September was just what Putin was looking for. Putin only wishes the prices had stayed up. Pickens recently stated, “A lack of leadership in the United States has allowed Putin to walk into the Middle East and be right there.” While some don’t see the intervention in Syria as having a lasting impact, others feel it is a long-term play that could affect prices as Putin appears to stop at nothing to reach his goals. Of course, in addition to bumping up oil prices, Putin wants to deflect attention from Russian aggression in Ukraine and he wants to prevent the fall of his Syrian ally, Assad. And by challenging ISIS, he hopes to take control of as many of the terrorist group’s oil assets as he can. The more prolonged the war in the Middle East, the more likely Putin’s moves will boost oil prices.

As we entered 2016, jawboning among OPEC and non-OPEC producers continued, but little in the way of serious production cuts was achieved. Agreements to limit production to already too-high levels haven’t done much to drive prices up, especially as Iranian production has flooded the already saturated market. For now, the strategy seems bent on fighting for market share while causing production cuts in the United States. If OPEC and non-OPEC producers make some quick decisions that it is time to get serious about cutting production, crude oil and propane prices will move up accordingly.

Further, on Aug. 15, 1914, the Panama Canal moved the first cargo ship through and sent it on its way to Asia, changing forever the dynamics of global seaborne trade. Just a little over a century later, a newly expanded Panama Canal is going to once again cause major changes for seaborne trade. Larger ships that until now have had to sail all the way around the southern tip of South America will be able to traverse the canal, meaning world seaborne trade through the canal will rise from 3% to 6%, or even 7%. The $6-billion expansion, originally to have been completed by the 100-year anniversary of the canal in 2014, is running two years behind schedule. It is now 96% complete and is expected to be open in May of this year.

Any sector where the U.S. is a net exporter will likely see expansion. While the paper, raw textile, and machinery industries will likely see a modest increase in exports, some industries such as steel, cement, and fertilizer will see losses as competing countries will pay less to get their products to the U.S. Who will be the biggest beneficiaries of the expanded Panama Canal? The agriculture and natural gas sectors will benefit greatly. Among those poised to benefit the most are shippers of LNG and LPG.

Before you get too excited for the new opportunities for propane, keep in mind this change may not benefit you at all unless you happen to be fairly high up in companies such as Targa Resources Partners, Enterprise Products Partners, Ferrellgas Partners, AmeriGas Partners, Suburban Propane Partners, DCP Midstream Partners, and NGL Energy Partners. Additional exports will very likely just drive up the wholesale domestic cost for the rest of the U.S. propane industry.

The opening of the Panama Canal will allow very large gas carriers (VLGCs) to cut travel time from the U.S. Gulf to Asia from 41 days at sea to 25 days. This is a huge benefit for shippers as it brings shipping time almost even with shipping from the Middle East to Asia, making U.S. product more competitive. With record exports of 729,000 bbld—nearly 22 MMbbl a month—now, this is one more factor that will keep product flowing out of the U.S. at an even faster rate than ever before.

Keep in mind that up until 2010, the U.S. capacity to ship propane was only 4 MMbbl a month. As shale production ramped up beginning a little over 10 years ago, the price of crude oil was beginning to soar to new heights. And while propane prices moved up, they did not rise at the pace of crude oil. With all of the production increases, even with the export capacity having ramped up significantly in the past five years, we still see disparities in prices around the globe. June 2015 propane in Edmonton, Alta. was at 2 cents/gal., while U.S. Gulf Coast, Northwest Europe, and Japan propane were at 36 cents/gal., 68 cents/gal., and 96 cents/gal., respectively.

Propane continued to fluctuate up and down in tandem with crude oil changes as it still does today, but it does so at a significantly lower percentage to the crude price. When measured in gallons, propane used to be considered balanced at 75% of the price of crude oil. Lately, Mont Belvieu propane has been trading closer to 42% of crude oil priced in gallons. It has long been thought that as exports ramped up to be more in balance with the rapidly expanded U.S. production rates, propane would once again trade at a higher percentage to crude. To put it in perspective, 75% of crude at $32/bbl (76 cents/gal. in gallons) would be 57 cents/gal. With a move back up to just $50/bbl (119 cents/gal. in gallons), 75% of crude is 89 cents/gal.

The opening of the Panama Canal is just one factor to be aware of that will likely dramatically further boost exports from the U.S. Another factor is the continued rapid growth of export capacity. The small number of companies that are largely responsible for having increased our infrastructure have put billions of dollars into their projects. Enterprise Products Partners alone has just completed a new expansion phase taking export capacity to 16 MMbbl a month. Targa Resources Partners, until recently the only other operator of a major U.S. LPG export terminal, represents a little over a third of Enterprise’s capacity.

Several others, such as Phillips 66, Sunoco Logistics, and Occidental Petroleum, are building additional export facilities and all three have the advantage of a more congestion-free location well away from the busy Houston Ship Channel. In addition, Sunoco Logistics is the first with the ability to ship from the East Coast. Mariner East, a new LPG and ethane export facility on the Delaware River at Marcus Hook near Philadelphia, will help the company benefit from being able to ship a lot of the new LPG being produced in the Marcellus region. With all of the projects still under way, shipping capacity is expected to increase by an additional 40% by the end of 2017.

Where is all the propane going? Latin America has been a long-time importer of U.S. propane, and its demand continues to grow. European demand for U.S. exports is growing and we have seen rapid growth in Asian demand, particularly from China and India. Chinese imports almost doubled from 2013 to 2014. India’s demand has increased each month for more than two years. The U.S. should continue to gain market share in Asian countries where demand is growing, both due to increased shipping capacity and lower shipping costs. Further, China and India want the U.S. and OPEC countries to compete for their business.

An additional factor ready to facilitate exports will be lower seaborne shipping costs due to lower freight rates. With Asian countries diversifying from Middle East LPG to U.S. LPG, the need for more ships has increased dramatically. More VLGCs are being built quickly. In the meantime, the demand for these large ships has allowed freight rates to rise significantly, but as many more VLGCs are built, freight rates are expected to come down. A rapid decrease is not expected, but declines in rates are expected to be seen by mid-2016. In addition to the supply and demand of ships, costs may decline due to the increased efficiency of the newer ships. Dorian LPG, for example, says its new ships consume 17% less fuel than previous VLGCs as they have improved propulsion-system efficiency and now handle cargo more flexibly.

The question is not whether U.S. propane prices will align more closely with the world market in the future, but when. Once again, nothing cures low prices like low prices. Low prices have already caused production growth to slow in the various shale projects, and low prices have countries such as Canada also ramping up exports to Asia, with a short 12-day journey from the North American West Coast to China. Canada would rather sell product to Asia at 96 cents/gal. than to U.S. customers in a position to transport it from Edmonton for 2 cents/gal.

For the retail propane market, the question is whether waiting for another 10-cent/gal. price decline is worth the risk of a steady 30-cent/gal. gain during 2016. It may be worthwhile to go ahead and lock in more volume now while approaching customers, especially high-volume consumers, about the likely benefits of locking in low-cost volumes not only for 2016-2017, but for 2017-2018 as well.

Pat Thornton joined Mission, Kan.-based Propane Resources in 1996. He provides the Supply Division’s risk-management and supply-planning services in the east-central U.S.