Thursday, May 12, 2016

In the long run, U.S. NGL producers will have major cost advantages over their international peers, says Bill Briggs, director, waterborne NGL origination at Phillips 66. Any production growth slowdown is likely to be temporary due to cost deflation, high grading, innovation, consolidation, and global fundamentals. With international demand expected to grow by 42% from 2011 to 2025, Phillips 66 in the second half of this year is scheduled to bring online its Freeport, Texas LPG export terminal as part of its Sweeny Hub initiative.

In a presentation at the February Argus Americas LPG Summit in Key Largo, Fla., Briggs, a graduate of the U.S. Merchant Marine Academy at Kings Point, N.Y. and a 19-year commercial marine industry veteran, noted that the outlook for U.S. LPG supply points to growing exports. “U.S. LPG supply has grown by 90% since 2005 and is expected to continue growing, albeit with a potential short-term slowdown due to market economics,” he said. “Phillips 66’s Freeport export terminal will be operational in the second half of 2016 and will be a world-class LPG export facility.”

He added that U.S. exports will become more advantaged into overseas markets as freight rates decline with the delivery of additional very large gas carriers (VLGCs) and when the Panama Canal expansion becomes operational. “International demand is expected to increase an additional 25% over the next 10 years, especially in the Asian markets,” Briggs said.

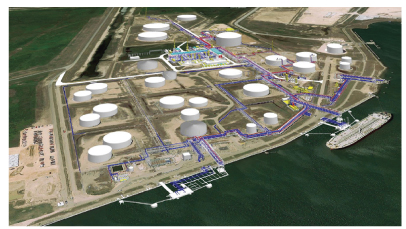

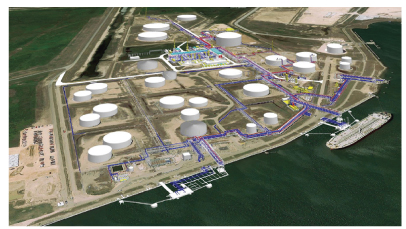

To that end, the new export terminal will provide 4.4 MMbbl a month of LPG export capacity, the equivalent of eight VLGCs. The facility is located on the site of an existing crude import marine terminal in Freeport and utilizes existing Phillips 66 midstream, transportation, and storage infrastructure. Export terminal infrastructure includes a 550,000-bbl refrigerated propane tank, LPG salt dome storage, and four refrigeration trains. There are two new LPG-ship-capable loading docks and two loading arms per dock. Two ships can be loaded simultaneously at a rate of up to 36,000 bbl an hour.

Briggs commented that advantages of the terminal, which lies 30 miles inland, include a one-and-a-half-hour transit time to and from open water, a nominal 40-ft draft, expansion capability, and the limited potential for expansive port growth going forward, meaning waterway congestion isn’t just over the horizon. He contrasted Freeport with the Houston Ship Channel, where he said congestion is expected to increase with projected expansions.

“Freeport’s competitive position is that it avoids the congestion and fog delays of Houston, provides connectivity to Mont Belvieu, and is strategically located near West Texas NGL supply. There are fewer issues of nighttime operation restrictions and escort requirements. Freeport leverages existing refinery and terminal assets, there’s available salt dome storage, and there is access to a deep harbor.”

As part of its Sweeny Hub project, Phillips 66 last December began operations at its new 100,000-bbld Fractionator One at the company’s Sweeny Complex in Old Ocean, Texas. Sweeny Fractionator One currently supplies purity ethane and LPG to the petrochemical industry and heating markets, and is supported by 250 miles of new pipelines and a multimillion-barrel cavern complex. LPGs produced at the facility are being delivered via pipeline to local petrochemical customers, as well as to the Mont Belvieu market hub. Phillips 66 will have the capability to place LPG into the global marketplace upon commissioning of the 150,000-bbld Freeport export terminal later this year.

Sweeny Fractionator One and the export terminal represent a combined capital investment of more than $3 billion by Phillips 66. Fractionator One is located near the company’s Sweeny refinery in Old Ocean. Several pipelines, including the Sand Hills Pipeline, supply NGL feedstock to the facility, and a bilateral pipeline runs between Sweeny and Mont Belvieu.

Phillips 66 holds direct interests in three NGL fractionators and gathering systems in strategic NGL hubs in the U.S. The company owns 22.5% of Gulf Coast Fractionators, which owns a fractionating facility in Mont Belvieu. Ownership also includes a 12.5% stake in an Enterprise fractionator at Mont Belvieu and 40% ownership of a fractionator at Conway, Kan.

Along with those, Phillips 66 owns interests in gathering and interstate transmission pipeline systems. The pipelines gather and deliver Y-grade to supply its facilities at the joint-venture Borger refinery in Texas and the fractionators in Mont Belvieu and Conway. Phillips 66 holds one-third ownership interests in the Sand Hills and Southern Hills NGL pipelines, which connect production from the Eagle Ford Shale Basin, Permian Basin, and Mid-Continent to Texas Gulf Coast markets. DCP Midstream operates the pipelines, which began service in 2013. —John Needham

In a presentation at the February Argus Americas LPG Summit in Key Largo, Fla., Briggs, a graduate of the U.S. Merchant Marine Academy at Kings Point, N.Y. and a 19-year commercial marine industry veteran, noted that the outlook for U.S. LPG supply points to growing exports. “U.S. LPG supply has grown by 90% since 2005 and is expected to continue growing, albeit with a potential short-term slowdown due to market economics,” he said. “Phillips 66’s Freeport export terminal will be operational in the second half of 2016 and will be a world-class LPG export facility.”

He added that U.S. exports will become more advantaged into overseas markets as freight rates decline with the delivery of additional very large gas carriers (VLGCs) and when the Panama Canal expansion becomes operational. “International demand is expected to increase an additional 25% over the next 10 years, especially in the Asian markets,” Briggs said.

To that end, the new export terminal will provide 4.4 MMbbl a month of LPG export capacity, the equivalent of eight VLGCs. The facility is located on the site of an existing crude import marine terminal in Freeport and utilizes existing Phillips 66 midstream, transportation, and storage infrastructure. Export terminal infrastructure includes a 550,000-bbl refrigerated propane tank, LPG salt dome storage, and four refrigeration trains. There are two new LPG-ship-capable loading docks and two loading arms per dock. Two ships can be loaded simultaneously at a rate of up to 36,000 bbl an hour.

Briggs commented that advantages of the terminal, which lies 30 miles inland, include a one-and-a-half-hour transit time to and from open water, a nominal 40-ft draft, expansion capability, and the limited potential for expansive port growth going forward, meaning waterway congestion isn’t just over the horizon. He contrasted Freeport with the Houston Ship Channel, where he said congestion is expected to increase with projected expansions.

“Freeport’s competitive position is that it avoids the congestion and fog delays of Houston, provides connectivity to Mont Belvieu, and is strategically located near West Texas NGL supply. There are fewer issues of nighttime operation restrictions and escort requirements. Freeport leverages existing refinery and terminal assets, there’s available salt dome storage, and there is access to a deep harbor.”

As part of its Sweeny Hub project, Phillips 66 last December began operations at its new 100,000-bbld Fractionator One at the company’s Sweeny Complex in Old Ocean, Texas. Sweeny Fractionator One currently supplies purity ethane and LPG to the petrochemical industry and heating markets, and is supported by 250 miles of new pipelines and a multimillion-barrel cavern complex. LPGs produced at the facility are being delivered via pipeline to local petrochemical customers, as well as to the Mont Belvieu market hub. Phillips 66 will have the capability to place LPG into the global marketplace upon commissioning of the 150,000-bbld Freeport export terminal later this year.

Sweeny Fractionator One and the export terminal represent a combined capital investment of more than $3 billion by Phillips 66. Fractionator One is located near the company’s Sweeny refinery in Old Ocean. Several pipelines, including the Sand Hills Pipeline, supply NGL feedstock to the facility, and a bilateral pipeline runs between Sweeny and Mont Belvieu.

Phillips 66 holds direct interests in three NGL fractionators and gathering systems in strategic NGL hubs in the U.S. The company owns 22.5% of Gulf Coast Fractionators, which owns a fractionating facility in Mont Belvieu. Ownership also includes a 12.5% stake in an Enterprise fractionator at Mont Belvieu and 40% ownership of a fractionator at Conway, Kan.

Along with those, Phillips 66 owns interests in gathering and interstate transmission pipeline systems. The pipelines gather and deliver Y-grade to supply its facilities at the joint-venture Borger refinery in Texas and the fractionators in Mont Belvieu and Conway. Phillips 66 holds one-third ownership interests in the Sand Hills and Southern Hills NGL pipelines, which connect production from the Eagle Ford Shale Basin, Permian Basin, and Mid-Continent to Texas Gulf Coast markets. DCP Midstream operates the pipelines, which began service in 2013. —John Needham