Tuesday, July 19, 2016

By Diane Schumm… You may already be aware of the effect of delinquent accounts on your business, but you may not know that the age of delinquent accounts contributes to the overall success rate for recovery of lost income. As a delinquent account ages, the likelihood of collectability decreases, increasing the amount of income you’ll have to write off each year.

Why Early Intervention Is Critical

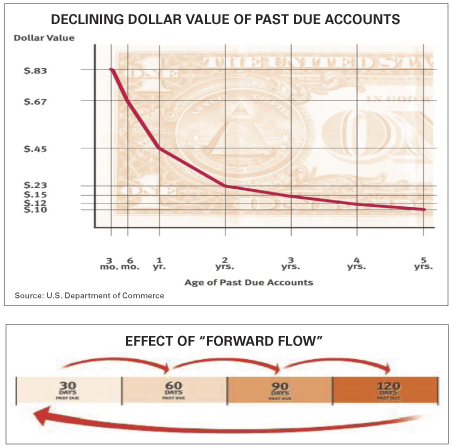

You rely on your customer relationships. They build your repeat business, provide referrals, protect your reputation, and guarantee longevity. Wouldn’t you rather focus on building even better relationships with your most valued clients instead of on clients avoiding your requests for payment? You may want to give your customers more time to pay their delinquent accounts, but the Department of Commerce reports:

a.) Accounts three months past due are worth $.83 on the dollar

b) Accounts six months past due are worth $.67 on the dollar

c) Accounts one year past due are worth $.45 on the dollar, and so on (see graph at right)

Accounts eventually deteriorate to a point where they become practically worthless. In addition, the longer you wait, the more aggressive you have to be to recapture that lost revenue. When you establish contact early, you can maintain a customer service approach with your clients. Instead of a reprimand for late payments, you remind them of their balance, make inquiries into their situation, offer assistance, education, and support. You’d be surprised at how receptive and responsive customers are to this approach.

Questions to Determine How Age Effects Your Accounts

If you still wonder how age directly influences your accounts, ask yourself the following questions:

1. How many accounts do you have on the books that are causing you concern?

The number of accounts that are of concern will influence the number of accounts that begin to age. The larger the number, and the greater the balance, the more effort an already over-stressed staff will have to exert to recover the debt, leading to a greater likelihood of those balances sliding from 30 to 60 to 90 days overdue.

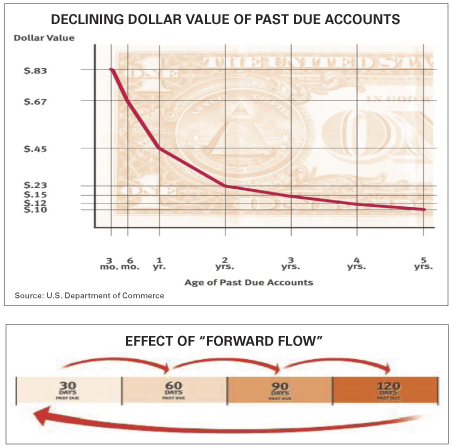

2. How many accounts will experience a “forward flow”?

Many business owners focus on accounts that are 90 to 120 days old, but the problem is that while you’re attempting to collect on older accounts, your 30- to 60-day-old accounts are sliding forward another 30 days. While trying to address the cycle, new accounts become 30 days delinquent, further perpetuating the vicious cycle.

3. If you could focus all of your efforts on the 30- to 60-day-old slow-pay accounts this month, how many do you think you could prevent from reaching the 90-day aging period next month?

If you’re able to focus your efforts on halting the aging process, you will recover more income and have greater customer retention as your efforts can revolve around education and prevention rather than collection.

When a Third-Party Partner Is Necessary

By partnering with a dedicated accounts receivable (A/R) management vendor, you can focus your energy on sales and production while leveraging third-party authority for your accounts. Unlike a traditional collections agency, an accounts receivable vendor focuses on customer retention by using non-alienating methods to alert customers to their delinquent accounts. The approach recognizes that your customers are the heart and soul of your business and places greater value on those relationships.

An accounts receivable management team can act as an extension of your own internal billing efforts or can take the burden of account management off your plate. A reputable A/R vendor can handle everything from initial billing to notification of delinquency and will even seek legal action if warranted and authorized by your company. They will truly serve as a partner in maintaining your healthy A/R. Associating with a third-party A/R management vendor that can effectively promote customer loyalty vs. just being your last resort to profit losses is one of the best ways to prevent delinquent accounts from aging.

Preventive Maintenance Equals Positive Results

There are a number of positive benefits to focusing on early intervention for your accounts. Not only will you experience greater recovery results, but you’ll receive better responses from your customers. The number of delinquent accounts will be reduced in a hassle-free manner, which will lead to fewer collection issues down the line. The benefits to your business are immeasurable when you make A/R management a priority.

Diane Schumm, This email address is being protected from spambots. You need JavaScript enabled to view it., is vice president of corporate services for TekCollect.

Why Early Intervention Is Critical

You rely on your customer relationships. They build your repeat business, provide referrals, protect your reputation, and guarantee longevity. Wouldn’t you rather focus on building even better relationships with your most valued clients instead of on clients avoiding your requests for payment? You may want to give your customers more time to pay their delinquent accounts, but the Department of Commerce reports:

a.) Accounts three months past due are worth $.83 on the dollar

b) Accounts six months past due are worth $.67 on the dollar

c) Accounts one year past due are worth $.45 on the dollar, and so on (see graph at right)

Accounts eventually deteriorate to a point where they become practically worthless. In addition, the longer you wait, the more aggressive you have to be to recapture that lost revenue. When you establish contact early, you can maintain a customer service approach with your clients. Instead of a reprimand for late payments, you remind them of their balance, make inquiries into their situation, offer assistance, education, and support. You’d be surprised at how receptive and responsive customers are to this approach.

Questions to Determine How Age Effects Your Accounts

If you still wonder how age directly influences your accounts, ask yourself the following questions:

1. How many accounts do you have on the books that are causing you concern?

The number of accounts that are of concern will influence the number of accounts that begin to age. The larger the number, and the greater the balance, the more effort an already over-stressed staff will have to exert to recover the debt, leading to a greater likelihood of those balances sliding from 30 to 60 to 90 days overdue.

2. How many accounts will experience a “forward flow”?

Many business owners focus on accounts that are 90 to 120 days old, but the problem is that while you’re attempting to collect on older accounts, your 30- to 60-day-old accounts are sliding forward another 30 days. While trying to address the cycle, new accounts become 30 days delinquent, further perpetuating the vicious cycle.

3. If you could focus all of your efforts on the 30- to 60-day-old slow-pay accounts this month, how many do you think you could prevent from reaching the 90-day aging period next month?

If you’re able to focus your efforts on halting the aging process, you will recover more income and have greater customer retention as your efforts can revolve around education and prevention rather than collection.

When a Third-Party Partner Is Necessary

By partnering with a dedicated accounts receivable (A/R) management vendor, you can focus your energy on sales and production while leveraging third-party authority for your accounts. Unlike a traditional collections agency, an accounts receivable vendor focuses on customer retention by using non-alienating methods to alert customers to their delinquent accounts. The approach recognizes that your customers are the heart and soul of your business and places greater value on those relationships.

An accounts receivable management team can act as an extension of your own internal billing efforts or can take the burden of account management off your plate. A reputable A/R vendor can handle everything from initial billing to notification of delinquency and will even seek legal action if warranted and authorized by your company. They will truly serve as a partner in maintaining your healthy A/R. Associating with a third-party A/R management vendor that can effectively promote customer loyalty vs. just being your last resort to profit losses is one of the best ways to prevent delinquent accounts from aging.

Preventive Maintenance Equals Positive Results

There are a number of positive benefits to focusing on early intervention for your accounts. Not only will you experience greater recovery results, but you’ll receive better responses from your customers. The number of delinquent accounts will be reduced in a hassle-free manner, which will lead to fewer collection issues down the line. The benefits to your business are immeasurable when you make A/R management a priority.

Diane Schumm, This email address is being protected from spambots. You need JavaScript enabled to view it., is vice president of corporate services for TekCollect.