Thursday, December 28, 2017

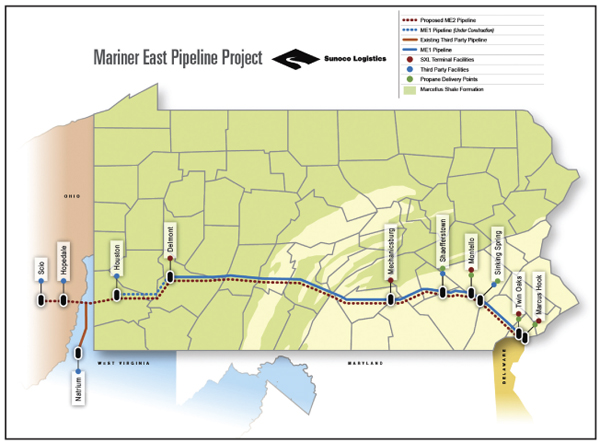

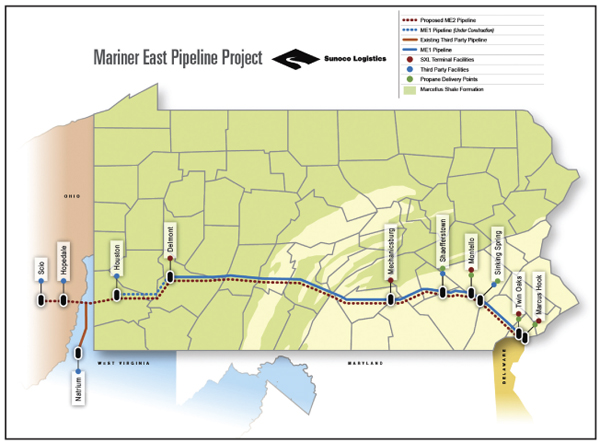

By now, you’ve probably heard about Mariner East 2 (ME2). Since the pipeline is in our backyard, it’s one of those things we feel we should understand, even if we’re a little confused. So let’s walk this through. To begin, it was just announced that operation of the pipeline has been delayed until Spring 2018, from an original start date of November. This isn’t a surprise to anyone, least of all anyone involved in shipping NGLs to Marcus Hook, Pa. for the export market.

The capacity of the second Mariner pipeline is approximately 11.5 million gallons per day of propane, butane, and ethane. Much of the propane supply that was scheduled to be shipped on ME2 and then exported from the East Coast now needs to find a way onto ships along the Gulf Coast. To do that, 100, plus or minus, railcars at a time called unit trains are sent from the Marcellus and Utica shale regions of West Virginia, Ohio, and western Pennsylvania to Conway, Kan. The supply is then piped to the Gulf Coast for waterborne exports.

Not all of this new propane supply earmarked for Marcus Hook is going to the Far East via Kansas. Much of it is still going directly to Marcus Hook, but by rail instead of pipeline. If that propane supply is needed here in the Northeast this winter, meaning we’ll pay more than the international market, it will stay here.

Backwardation This summer our propane market switched from one that was in contango — worth more each month — which encourages storing production, to a market in backwardation — worth less each month — which discourages storing production. Backwardation occurs because supply tightness exists, but the conditions that created the tightness in the current month are not expected to be present in future months. The monthly price difference can be minimal, or it can be great.

The backwardation for propane between the first quarter of 2018 and the second quarter has recently been near a record discount of 17 cents/gal. And the recent Brent crude discount of $2/bbl one year out is the largest in three years. A commodity market in backwardation is fundamentally bullish. Why? The consumer is telling the producer: We can’t wait. We need it now.

Price Spikes The folks that produce our propane are selling as much as they can. There is no incentive for them to pay for it to go into, and out of, storage. Why sell in a few months at a discount? It is far better to collect a premium now. The sell-now mentality is in overdrive. Unfortunately for us, the international customer is the preferred customer. If we want to move up to first class, we’ll need to pay for the upgrade.

In our October 2016 blog we asked, what is the world willing to pay? The concern will be when the world community tries to outbid the U.S. for our abundant propane supply, regardless of price. In the last six months we’ve seen little retail demand and low petrochemical demand for propane. If retail and petrochemical demand pick up, an international bidding war is possible for the propane we make and the propane we have in storage. Monthly demand could begin to greatly exceed monthly supply since the folks that make our propane are already selling all they can.

Any Good News? There is. Bear with me. Crude prices dropped under $50/bbl in May and rig counts had been on a declining trend since this summer. So, when WTI crude oil prices moved back over $50/bbl in September, I thought we’d see increases in rig counts, an indicator of future production, within eight weeks, the average lag time. But we didn’t, until recently.

Baker Hughes publishes oil and gas rig counts. The week of Nov. 5 the oilfield service company reported the U.S. added nine oil rigs, the greatest weekly increase since June, bringing the total to 738, versus 452 last year. With oil prices now at two-year highs, this rig count trend should continue and help propane production.

Our energy industry is mercurial. Crude oil prices and rig counts are up, down, up. It reminds me of the Charlie Brown cartoon where Lucy keeps pulling the football away from Charlie, but each time reassuring him she won’t do it again. In this case the football is $50/bbl crude oil. ConocoPhillips is one of the largest oil and gas producers in the country and the company plans to spend $5.5 billion a year as long as oil prices stay above $50/bbl. It sounds encouraging, but what if Lucy pulls the ball away again?

Backwardation may also explain the lack of enthusiasm for U.S. exploration and production. For two years now it’s been tough to finance exploration projects when the futures market discounts haven’t allowed companies to lock in acceptable returns. And that has been the strategy behind OPEC’s short-term production cuts all along.

Since nearly 50% of all U.S. propane production is exported now — about 42 million gallons per day, or the equivalent of three very large ships a day — the only things that can help propane levels are expanding production and declining export demand. Expanding production — higher crude oil prices and rig counts, along with stable natural gas prices, may mean we’re turning the corner. And regarding the scenario for declining export demand, high prices should create demand destruction, with buyers thinking: sorry, but at these prices I think I’ll go back to burning cow dung.

My best guess for a short-term price range for Mont Belvieu propane is 79.00 cents/gal. to 120.00 cents/gal. But a break above 120.00 cents could pave the way to 160.00 cents. Further, propane inventories drew down a larger-than-expected 2.52 MMbbl to 74.68 MMbbl the week ended Nov. 10. Total U.S. stocks were 26% behind last year.

But the skinny is, our Northeast propane industry doesn’t really have a supply problem. We have a complacency problem. And that’s understandable. After all, we’ve had two mild winters in a row. But now we’ve set ourselves up to compete against the rest of the world this winter for approximately 75 to 100 million incremental gallons—10% to 15% of which is projected under contract.

Stephen Heffron, vice president of marketing at Troy, N.Y.-based Ray Energy, has nearly 30 years of experience in wholesale propane supply and distribution in the Northeast U.S. and Canada. He is the author of the Heffron Blog.

The capacity of the second Mariner pipeline is approximately 11.5 million gallons per day of propane, butane, and ethane. Much of the propane supply that was scheduled to be shipped on ME2 and then exported from the East Coast now needs to find a way onto ships along the Gulf Coast. To do that, 100, plus or minus, railcars at a time called unit trains are sent from the Marcellus and Utica shale regions of West Virginia, Ohio, and western Pennsylvania to Conway, Kan. The supply is then piped to the Gulf Coast for waterborne exports.

Not all of this new propane supply earmarked for Marcus Hook is going to the Far East via Kansas. Much of it is still going directly to Marcus Hook, but by rail instead of pipeline. If that propane supply is needed here in the Northeast this winter, meaning we’ll pay more than the international market, it will stay here.

Backwardation This summer our propane market switched from one that was in contango — worth more each month — which encourages storing production, to a market in backwardation — worth less each month — which discourages storing production. Backwardation occurs because supply tightness exists, but the conditions that created the tightness in the current month are not expected to be present in future months. The monthly price difference can be minimal, or it can be great.

The backwardation for propane between the first quarter of 2018 and the second quarter has recently been near a record discount of 17 cents/gal. And the recent Brent crude discount of $2/bbl one year out is the largest in three years. A commodity market in backwardation is fundamentally bullish. Why? The consumer is telling the producer: We can’t wait. We need it now.

Price Spikes The folks that produce our propane are selling as much as they can. There is no incentive for them to pay for it to go into, and out of, storage. Why sell in a few months at a discount? It is far better to collect a premium now. The sell-now mentality is in overdrive. Unfortunately for us, the international customer is the preferred customer. If we want to move up to first class, we’ll need to pay for the upgrade.

In our October 2016 blog we asked, what is the world willing to pay? The concern will be when the world community tries to outbid the U.S. for our abundant propane supply, regardless of price. In the last six months we’ve seen little retail demand and low petrochemical demand for propane. If retail and petrochemical demand pick up, an international bidding war is possible for the propane we make and the propane we have in storage. Monthly demand could begin to greatly exceed monthly supply since the folks that make our propane are already selling all they can.

Any Good News? There is. Bear with me. Crude prices dropped under $50/bbl in May and rig counts had been on a declining trend since this summer. So, when WTI crude oil prices moved back over $50/bbl in September, I thought we’d see increases in rig counts, an indicator of future production, within eight weeks, the average lag time. But we didn’t, until recently.

Baker Hughes publishes oil and gas rig counts. The week of Nov. 5 the oilfield service company reported the U.S. added nine oil rigs, the greatest weekly increase since June, bringing the total to 738, versus 452 last year. With oil prices now at two-year highs, this rig count trend should continue and help propane production.

Our energy industry is mercurial. Crude oil prices and rig counts are up, down, up. It reminds me of the Charlie Brown cartoon where Lucy keeps pulling the football away from Charlie, but each time reassuring him she won’t do it again. In this case the football is $50/bbl crude oil. ConocoPhillips is one of the largest oil and gas producers in the country and the company plans to spend $5.5 billion a year as long as oil prices stay above $50/bbl. It sounds encouraging, but what if Lucy pulls the ball away again?

Backwardation may also explain the lack of enthusiasm for U.S. exploration and production. For two years now it’s been tough to finance exploration projects when the futures market discounts haven’t allowed companies to lock in acceptable returns. And that has been the strategy behind OPEC’s short-term production cuts all along.

Since nearly 50% of all U.S. propane production is exported now — about 42 million gallons per day, or the equivalent of three very large ships a day — the only things that can help propane levels are expanding production and declining export demand. Expanding production — higher crude oil prices and rig counts, along with stable natural gas prices, may mean we’re turning the corner. And regarding the scenario for declining export demand, high prices should create demand destruction, with buyers thinking: sorry, but at these prices I think I’ll go back to burning cow dung.

My best guess for a short-term price range for Mont Belvieu propane is 79.00 cents/gal. to 120.00 cents/gal. But a break above 120.00 cents could pave the way to 160.00 cents. Further, propane inventories drew down a larger-than-expected 2.52 MMbbl to 74.68 MMbbl the week ended Nov. 10. Total U.S. stocks were 26% behind last year.

But the skinny is, our Northeast propane industry doesn’t really have a supply problem. We have a complacency problem. And that’s understandable. After all, we’ve had two mild winters in a row. But now we’ve set ourselves up to compete against the rest of the world this winter for approximately 75 to 100 million incremental gallons—10% to 15% of which is projected under contract.

Stephen Heffron, vice president of marketing at Troy, N.Y.-based Ray Energy, has nearly 30 years of experience in wholesale propane supply and distribution in the Northeast U.S. and Canada. He is the author of the Heffron Blog.