Thursday, April 7, 2016

The U.S. now stands as the No. 1 LPG exporter in the world. Gulf Coast operators alone shipped about a half-million barrels of propane nearly every day last year, up 40% from 2014. Many of those waterborne cargos left the nation’s shores on very large gas carriers (VLGCs), each with the ability to carry a minimum of 550,000 bbl. Most of those vessels loaded propane and butane at terminals near Houston or Nederland, Texas, discharging their cargos as nearby as Latin America and the Caribbean but as far away as Japan and China. Nearly 27 MMbbl of propane left the U.S. in January, the latest data available, along with another 2.7 MMbbl of butane, reports the U.S. Department of Commerce (DOC). Propane exports grew 15.4% month over month; butane shipments were up 31.4%. For the year, propane exports soared 84.1% and butane 58.6%.

As noted at the February Argus Americas LPG Summit in Key Largo, Fla., the U.S. is not only the largest LPG exporter, but also the leading producer in the world, and one of the results of this exponential rise in production has been increased exports. LPG exports have surged to more than 16 million tonnes a year from a starting point of about 5 million tonnes less than 10 years ago, meanwhile transforming the global market. Additional projects to build new export facilities are planned, which could push U.S. export capacity to 40 million tonnes by 2018.

But the global LPG industry is facing a period of oversupply and rebalancing. Volatile crude oil prices are rippling throughout the downstream markets, and declines in overall energy production, both for oil and natural gas, threaten to lay down rigs and stem NGL production. “The aberration of low crude prices is becoming the new normal,” observed Nick Black, principal LPG, consulting, at Argus. “The crude price impact is hugely important.”

Craig Whitley, president and CEO of Houston-based World Energy Consultants LLC, emphasized that while most recent NGL infrastructure was built during a time of phenomenal margins, the market has changed. “It’s year two now with the same set of factors. The situation is that OPEC has flooded the oil market and has set about to cripple the U.S. oil and gas industry.” He added that low oil prices also mean low prices for naphtha, a crude-derived alternative to LPG for petrochemical cracking. While the impact of U.S. shale-based NGLs has led to record U.S. production, record export levels, including shipments to Latin America, Europe, and Asia, as well as record propane inventory levels, prices are sharply lower and many projects are under water.

Meanwhile, numerous NGL infrastructure projects have been built, among them pipelines, gas plants, fractionators, ethylene plants, propane dehydrogenation (PDH) facilities, and export terminals. Whitley underscored there are key questions for the industry. Will the world be able to absorb planned U.S. NGL production? Will U.S. NGL production volumes ever reach and sustain the levels required to financially support the infrastructure build-out?

Change is the only certainty in the oil and gas business, the former NGL analytics leader at BP affirmed, drawing attention to the recent era of energy scarcity, burgeoning import dependence, and high prices in the U.S. versus the current energy resurgence. However, certain factors remain constant, among them — LPG is a by-product of oil and natural gas. “In other words, being a byproduct of oil and gas production, LPG will never be the tail that wags the dog,” Whitley asserted. But that doesn’t mean it’s not important.

“When the oil-to-gas spread blew out producers laid down drilling rigs in dry gas shale plays like the Haynesville and moved them to liquids-rich plays like the Eagle Ford, Marcellus, Bakken, and Utica,” he pointed out. However, vulnerabilities exist, namely that most LPG comes from associated gas production, and changes in oil and associated gas production volumes will impact LPG production levels. “A classic example is the rise in U.S. NGL production that we’ve witnessed from higher production levels of oil and associated gas production related to shale oil and shale gas plays,” Whitley explained. “This direct linkage to oil is very important, as future oil production volumes will impact LPG production volumes.”

There may be some dark clouds on the horizon. The 45-year industry veteran noted that Goldman Sachs analysts recently predicted that the potential for Brent crude prices to fall to nearly $20/bbl is becoming greater as oil storages continue to fill. In addition, Saudi Arabia continues its strategy to protect market share and shows no sign of cutting back on production, despite pleas from Venezuela, Russia, and others to make cuts. Moreover, leading OPEC producers are also flexing their muscles. But why?

“OPEC never expected the huge success of shale oil, or the ability of the U.S. oil and gas industry to grow production so rapidly,” Whitley maintained. “With the entry of so many small and mid-size producers making an impact on U.S. production levels, building up debt along the way, Middle East producers feel they have a significant cost advantage and the staying power to curb U.S. production. OPEC’s strategy is to cripple the U.S. oil and gas industry, putting debt-ridden companies out of business and stemming U.S. oil production.”

He added that although monthly statistics from the Energy Information Administration do not reveal sharp drops in U.S. oil production yet, shut-ins are taking place and more bankruptcies are expected. “OPEC’s strategy is supported by the cartel’s knowledge that it has a lower cost of production than U.S. producers. While the cartel’s focus has been on increasing production, OPEC likely didn’t anticipate the slowdown in the Chinese economy would exacerbate the situation.”

Whitley observed that production drops in the U.S. have been minimal thus far due to the large number of drilled but uncompleted wells (DUCs) in early 2015. Those DUCs are said to number in the hundreds, if not thousands. As well, most producers were hedged through 2015 and there were major improvements in drilling technology, which reduced production costs. In summary, OPEC overlooked and underestimated the sheer volume of U.S. production volume that was hedged at higher prices, the number of drilled but uncompleted wells, the extremely high initial production rates from shale wells, and producer strategies related to DUCs and first-year production rates. Finally, America’s exploration and production technology continues to improve, sustaining its elevated status.

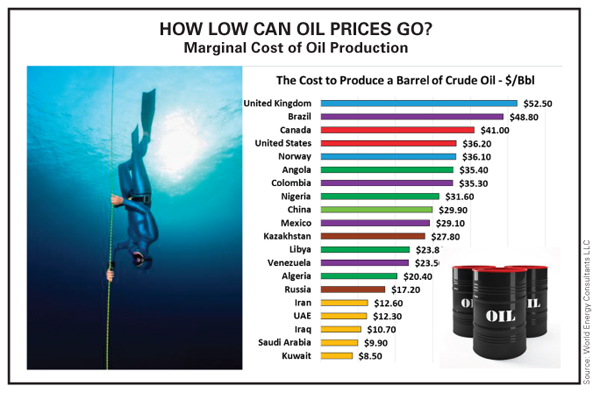

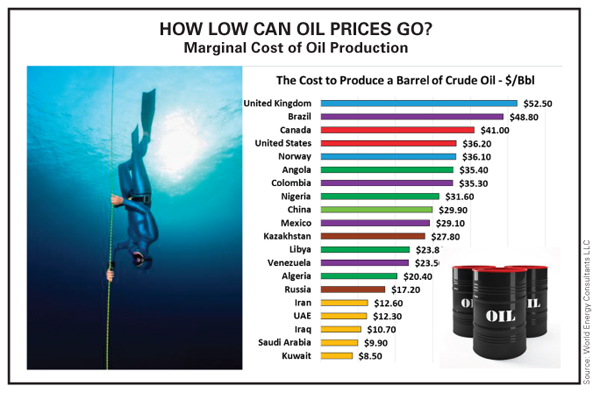

Whitley further commented that the U.S. reaction to lower oil prices was sharp and swift, proving Newton’s Third Law: “For every action, there is an equal and opposite reaction.” Technology enhancements led to more oil and gas produced per rig, and the number and lengths of laterals per well increased. But how low can oil prices go? Citing various sources, the former Purvin & Gertz senior partner reported that the United Kingdom has one of the highest marginal costs to produce a barrel of oil at $52.50/bbl, while Kuwait has one of the lowest at $8.50/bbl. The U.S. comes in at $36.20/bbl, while Venezuela is at $23.50/bbl and Russia’s cost is $17.20/bbl. Saudi Arabia’s reported production cost is $9.90/bbl. Iran, just now reentering the market after the lifting of sanctions over its nuclear program, has an estimated marginal cost of $12.60/bbl.

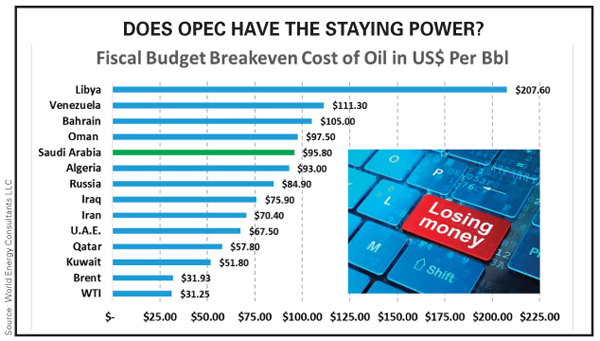

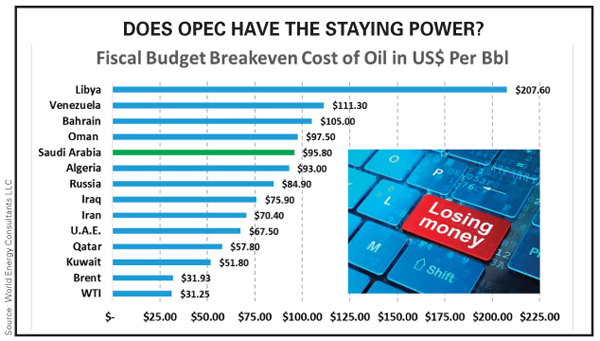

Does OPEC have the staying power? Although marginal production costs per barrel in the Middle East are low compared to the U.S., those costs say nothing about a nation’s fiscal budget breakeven costs when oil revenues weigh so heavily on a country’s income, wealth generation, and ability to meet its financial obligations, Whitley said. Using a fiscal budget breakeven cost calculation instead, an OPEC founding member country such as Venezuela needs $111.30/bbl; Saudi Arabia, $95.80/bbl; and Iraq, $75.90/bbl. The two remaining OPEC founding members, Iran and Kuwait, require $70.40/bbl and $51.80/bbl, respectively.

For other OPEC members, Libya is reported to require a fiscal budget breakeven price of $207.60/bbl; Algeria, $93.00/bbl; the United Arab Emirates, $67.50/bbl; and Qatar, $57.80/bbl. Outside that block, Russia’s breakeven price is $84.90/bbl. Contrast that to Brent crude, which breaks even at $31.93/bbl and West Texas Intermediate at $31.25/bbl. Undoubtedly, some OPEC members cannot sustain the current course. Even the deep-pocketed Saudis, which have rich financial reserves, have been calling upon those reserves to fill gaps in the domestic budget absent higher oil prices.

But while members of OPEC decide whether to hang together or hang separately, Whitley acknowledged the cartel’s strategy has achieved results. The price impact of surplus oil and LPG production have oil and propane on an MMBtu basis collapsing and moving toward gas values. “The gas-to-oil wedge is approaching historical levels,” he said. “Heating values for propane broke away from oil’s Btu value in late 2011 and remain lower than oil’s heating value.” Meanwhile, U.S. propane production and exports continued to rise even as prices plummeted.

However, lucky or unexpected factors fortunately aided the disposition of U.S. propane supplies. As outlined by Whitley, new Middle East supply projects have not evolved at the level and speed once expected by the industry. Also, LPG supply declines in Venezuela, delays in Brazilian LPG supply projects, lack of additional LPG developments in Peru, and new supplies from Colombia not meeting expectations are in play in Latin America. A notable exception is Bolivia, which has new supply initiatives under way, but the nation is a land-locked country. Further, China’s shale gas is mostly dry gas, and Argentina’s shale production has yet to make an impact. At the same time, lower oil prices are translating to reduced drilling activity and fewer LPG supply projects globally. Also, China’s PDH demand became a reality, diverting U.S. barrels to serve that sector.

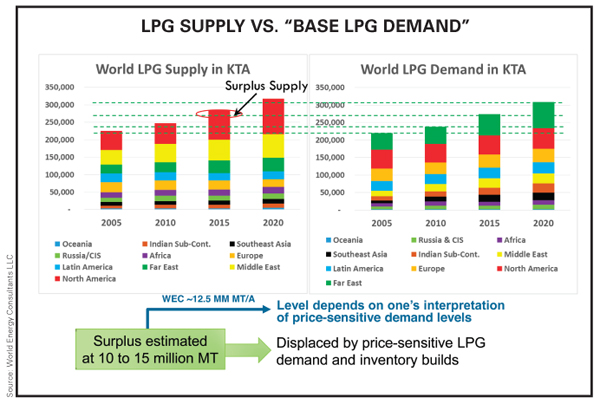

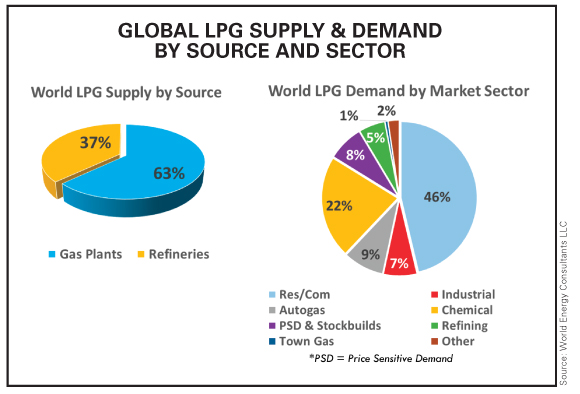

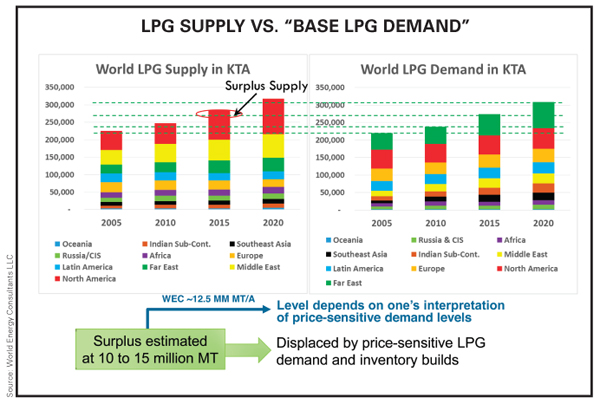

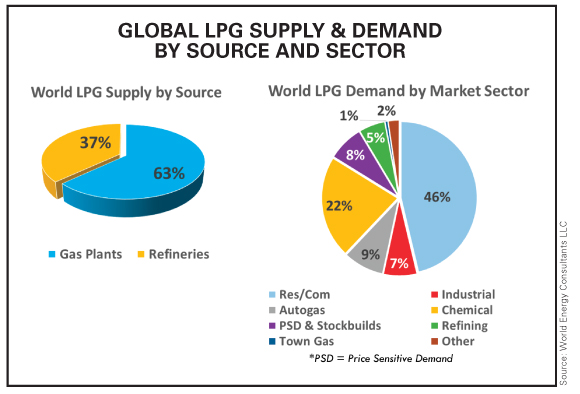

He cautioned that there is evidence of a global LPG supply surplus, and that the industry shouldn’t overlook global residential/commercial demand, which accounts for 46% of the total world market, followed by the chemical sector at 22%. The global residential/commercial sector grows roughly 3.0 to 3.3 million tonnes a year, or 96,000 bbld to 106,000 bbld, “hence roughly half of world LPG demand doesn’t have sufficient growth to support the huge rise planned for U.S. NGL production.” Whitley added that U.S. NGL producers and exporters are more dependent on price-sensitive demand growth and/or declines in foreign LPG supply than they realize. However, American PDH plants coming online will play a role in clearing some surplus propane supply.

“We can expect modest residential/commercial LPG demand growth to continue in future years as long as the world population is growing and the global economy isn’t suffering,” said Whitley. “Global residential/commercial LPG demand has grown as much as 7 million tonnes in good years and has realized annual declines during bleak economic times. Looking at the other side of the issue, if LPG can’t compete with naphtha, gasoline, or HFO [heavy fueloil], the global LPG industry will not have sufficient price-sensitive LPG market demand to consume the vast volumes of shale-based LPG that U.S. producers and exporters have planned.”

Looking forward, the World Energy Consultants CEO invoked economic fundamentals, namely the Third Law of Supply and Demand: If demand increases and supply remains the same, a shortage will occur, triggering an upward trend in prices to incentivize new supply. If demand decreases and supply remains the same, a surplus will evolve, creating a downward trend in prices to incentivize new demand. If supply increases and demand remains the same, a surplus will evolve causing prices to trend downward to incentivize new demand. Finally, if supply decreases and demand remains the same, a shortage will evolve causing prices to trend higher to incentivize new supply.

But has the Third Law of Supply and Demand engaged? Yes, but with provisos. As Whitley explained, oil and LPG prices have plummeted to stimulate new demand, but demand has failed to rise sufficiently to stop the price plummet. The more OPEC and U.S. energy production has risen, the lower oil and LPG prices have dropped. Low oil prices mean lower naphtha prices, making it difficult for LPG to gain new petrochemical market share. U.S. propane exports continue to rise, but low oil prices mean lower fueloil and diesel prices, making it difficult for LPG to gain traction in the power generation market. And low natural gas and LNG prices have also limited gas spiking demand for LPG. “U.S. propane exporters can thank a slowdown in Middle East supply growth and drops in LATAM [Latin American] production levels,” he said.

Whitley spotlighted that both oil and LPG are looking for Asia to solve surplus supply issues. However, the state of the Chinese economy is in question. Therefore, slower economic growth threatens to negatively impact Chinese oil and LPG demand. He noted that India “continues to do well and LPG demand growth is healthy,” but the Middle East has a huge freight advantage over U.S. supply due to the region’s proximity. “Japan, Korea, and Taiwan are very mature markets. South Korea does plan one new PDH plant. Most of Indonesia’s LPG demand growth from kerosene fuel-switching has already been realized.” He concluded that new PDH capacity, Asia Pacific light-ends (ethylene) cracking, and growth in China’s LPG import volumes are essential factors needed to balance global LPG supply with demand if shale gas production continues to grow.

He forecast the most likely outcome for how global supply will balance with demand. OPEC members are feeling the pinch of low prices, yet U.S. production volumes haven’t buckled to the degree the cartel hoped for. But this will change as hedges expire. Evidence that shut-ins are occurring already exist. “Despite restlessness and publicized disagreements among cartel members, OPEC will likely hold strong to its strategy for several more months,” Whitley predicted. “This could lead to Venezuela’s default. Prices will likely go even lower, leading to the production drops needed to balance global oil and LPG markets, but decisions will be made about oil, not LPG.”

On the positive side, he added that traders and analysts will see production declines as the indicator they have been looking for to support a price turnaround. “Expect higher prices before year-end. Meanwhile, the Saudis can hold on longer due to their vast cash reserves. Don’t be surprised if they enforce their strategy until they see several months of U.S. oil production declines and evidence that companies are crumbling apart or consolidating.”

Whitley concluded that the problem with global LPG supply is mostly a propane over-supply issue. It remains manageable, but could get worse if production continues to grow. In tandem, price-sensitive demand is hampered by low naphtha, HFO, diesel, and natural gas prices. But lower-than-expected LPG supply from Latin America and the Middle East has been a blessing in disguise for U.S. propane exporters. “The ‘Field of Dreams’ ‘build it and they will come’ mentality of American oil and gas producers has flooded the market with NGLs, leading to widespread ethane rejection, all-time high exports, and inventory levels,” he detailed. “These are bad times, but our industry will recover over the next six to 24 months.”

Nevertheless, on the way to that recovery names, faces, and ownership may change, he said. Return on investment on shale assets may fall below forecasts for a few years, but will prove warranted over time. “The early success that U.S. LPG producers and exporters have enjoyed in the international arena won’t be viewed as a fluke in future years. Foreign interest in U.S. LPG supply remains high. We’ve proven the international community needs U.S. LPG supply. Regardless of how 2016 turns out, the world will become even more dependent on U.S. LPG supply in future years.”

Market participants are readying for an even larger U.S. LPG export space. With terminal capacity-holders now reselling cargos and swapping loading dates, a new, robust LPG spot market is starting to emerge that is providing traders with liquidity and price discovery clarity. And that market is poised to grow as more terminal capacity comes online, more VLGCs are delivered, and new arbitrage opportunities open and close.

Argus explains that market forces set the price. U.S. Gulf Coast propane is heavily discounted, and as the arbitrage from the Gulf and other regions and spot freight rates move continually, term lifters at U.S. export terminals sometimes determine it is more profitable to resell a cargo than cancel it altogether. A term buyer will calculate the difference between the agreed cost of loading and the agreed cancellation fee, and then attempt to resell the cargo above the differential in the spot fob market.

For example, a term lifter who agreed to a terminalling fee of Mont Belvieu plus 8 cents/gal. may resell cargos at Mont Belvieu plus 3 cents/gal. rather than face an agreed 6 cents/gal. cancellation fee. If the difference between the terminalling fee and the cancellation fee — in this case 2 cents/gal. — is less than the spot fob price, then the term buyer will benefit from reselling the cargo rather than canceling it.

In other situations, the arbitrage to move cargos to other regions may be open, but the term lifter may have no access to a vessel. This may force the lifter to sell the allotted cargo on a spot basis, or perhaps swap loading dates with another lifter in a similar predicament. Traders and other buyers of these resold cargos are monitoring spot fob prices closely to take full advantage of opportunities, Argus comments. Further, the cost of moving propane out of the U.S. Gulf can vary enormously, depending on global demand for vessels. Owners of VLGCs typically charter them out on a dollars-per-day basis, although some will occasionally offer a dollars-per-tonne price for a single spot voyage.

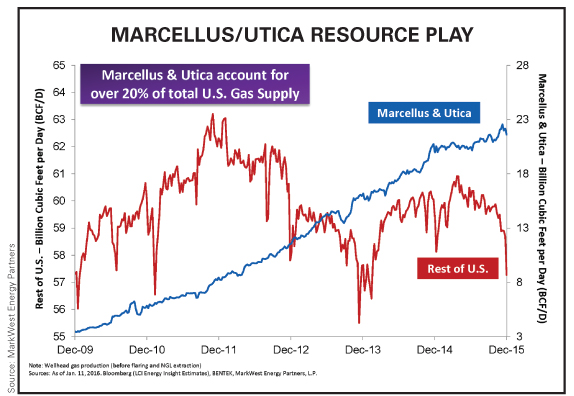

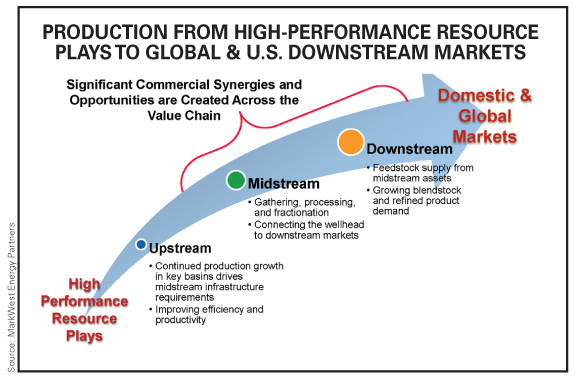

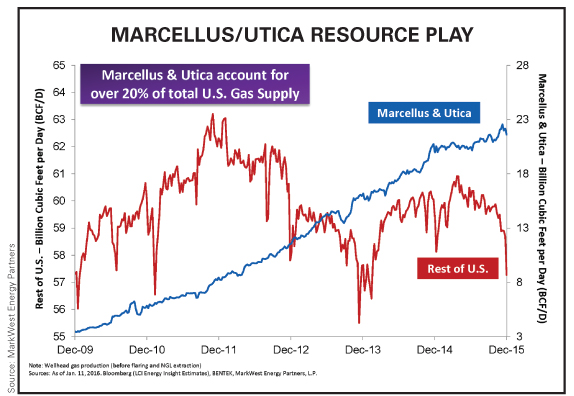

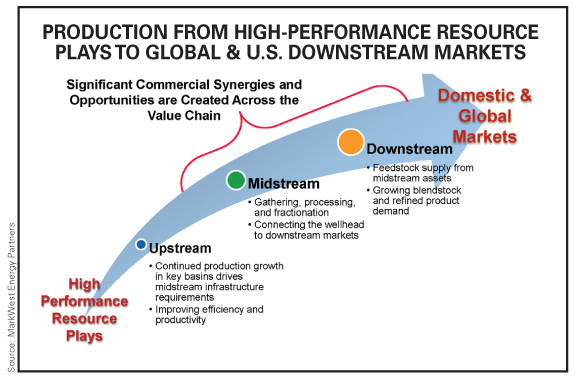

But where will all that supply for traders to buy and sell originate? Scott Garner, vice president, corporate development and joint venture management at MarkWest Energy Partners (Denver), pointed out to Argus Americas LPG Summit participants that the Marcellus and Utica shales are the leading U.S. natural gas growth plays. “This has meant a paradigm shift from the U.S. Northeast being a significant importer to a significant exporter,” he said. “Driven by Marcellus and Utica production growth, infrastructure continuing to be built out reflects those changes in trade flows.”

Garner noted that MarkWest operates 41 processing and fractionation facilities in the Marcellus and Utica shales and has 10 additional facilities under construction. “We currently process and fractionate approximately three-quarters of growing production from rich-gas areas in the Northeast. We have extensive long-term producer partnerships, with Marcellus and Utica area dedications of about 8 million acres.”

Online is 1 Bcfd of gathering capacity in the Marcellus, as well as 4 Bcfd of processing capacity and 357,000 bbld of C2-plus fractionation capability. Under construction is 1 Bcfd of cryogenic capacity and 124,000 bbld of shared fractionation capacity. In the Utica, MarkWest alone operates 1 Bcfd of gathering capacity, 1.3 Bcfd of processing capacity, and 160,000 bbld of fractionation volume. Another 200 MMcfd of cryogenic capacity and 60,000 bbld of shared C3-plus fractionation capacity is under construction.

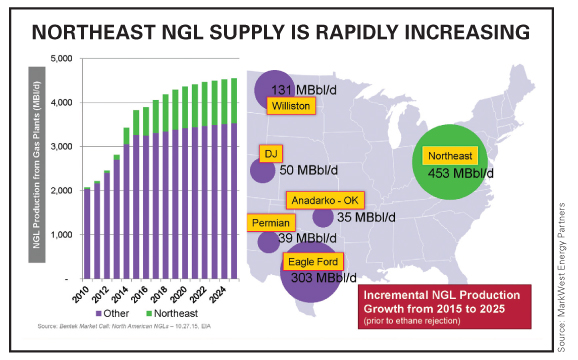

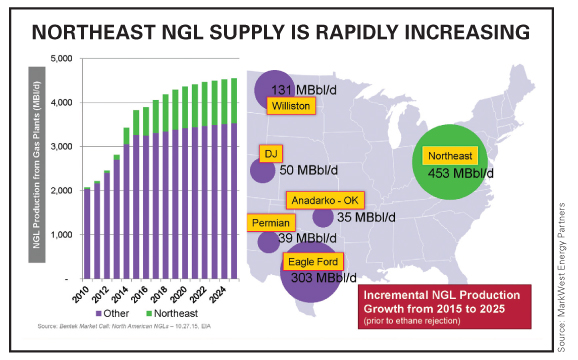

Garner outlined that Northeast NGL supply is rapidly increasing, and is forecast to account for 25% of total U.S. production in 2025. “‘Marcutica’ growth is seen even in a low commodity price environment,” he said, referring to the two shale plays. “Current NGL pricing is challenging. However, Mariner East, Cornerstone, and additional projects will return balance to Northeast supply and demand. Exports from the Northeast are geographically and structurally advantaged to Europe and parts of South America.”

Sunoco Logistics Partners LP (Philadelphia) said in March that Mariner East 1, the first pipeline in the company’s larger Mariner East system, was transporting propane and ethane to the Marcus Hook Industrial Complex and is approaching full operations as it completed loading of the first waterborne ethane shipment. Mariner East 1 is the first phase of the multifaceted Mariner East project. With the first pipeline up and running, the Marcus Hook Industrial Complex is positioned as an East Coast hub for processing and storing propane, ethane, and other NGLs from shale basins for distribution to local, domestic, and international markets. The 70,000 bbld of ethane and propane capacity for Mariner East 1 is available for intrastate and interstate service.

Mariner East 1, which originates in Washington County, southwest of Pittsburgh, began shipping propane in December 2014, serving local and regional propane shippers as well as the international market. Ethane shipments commenced last month, and the first tanker carrying ethane to Europe departed from Marcus Hook March 9. Mariner East 2, an expansion of the Mariner East system with origin points in Ohio, West Virginia, and western Pennsylvania, will add additional off-take points for propane shippers in central and eastern Pennsylvania. It is expected to be completed in the first half of 2017 and will add an additional 275,000 bbld of capacity for NGLs, primarily propane and butane, from the Marcellus and Utica shales. Mariner East 2 will provide both interstate service and intrastate service within Pennsylvania and has the potential to expand to 450,000 bbld.

The Cornerstone Pipeline and associated Utica build-out projects are initiatives of Marathon Pipe Line LLC and Ohio River Pipe Line LLC, subsidiaries of MPLX LP, a master limited partnership formed by Marathon Petroleum Corp. (Findlay, Ohio) in 2012. MarkWest Energy Partners is a wholly owned subsidiary of MPLX. The Cornerstone Pipeline will originate in Harrison County, Ohio and will deliver to Marathon Petroleum’s Canton, Ohio refinery and to an affiliated tank farm in East Sparta, Ohio. Cornerstone is being designed as a 16-in.-dia. system routed to provide connections to various Utica Shale condensate stabilization facilities, fractionators, and cryogenic facilities, along with potential future gathering and storage facilities. Cornerstone will be a batched system with the ability to transport condensate and NGLs.

The $2.2 billion allocated to Marathon Petroleum’s pipeline transportation segment this year includes $1.7 billion for MPLX. The largest component of the investment plan, more than $1.2 billion, is attributed to MarkWest’s ongoing development of natural gas and gas liquids infrastructure to support producer customers throughout the Southwest and Northeast regions, particularly in the Marcellus and Utica shales. MPLX continues its development of the Cornerstone Pipeline and is further expanding its Utica Shale build-out associated with the project.

Garner reported that a 23,000-bbld condensate stabilization facility was completed a year ago that will connect Utica and Marcellus NGLs to refinery and petrochemical markets. The facility will serve as the origin for the Cornerstone pipeline, delivering stabilized condensate to MPLX’s pipeline network. He noted that Cornerstone and the associated Utica build-out projects will provide optionality to multiple markets, maximizing producer netbacks and providing flexibility of commitment terms and seasonal shipper needs. Construction timetables are flexibly designed to allow MPLX to complete projects in phases as Utica production grows.

He characterized the infrastructure build-out as “developing Mont Belvieu capabilities in the Northeast” that will facilitate product exports to Canada and deliveries to the Gulf Coast for use in-region or for exports, to the Midwest, and to East Coast refineries and petrochemical facilities. “MarkWest’s NGL fractionation and marketing infrastructure is integral to supporting the abundant NGL supply in the Northeast,” he said. “Export facilities at multiple locations on the Eastern Seaboard will bring the Northeast back into supply balance, and growing regional NGL demand will come from refining, blending, and petrochemical projects.”

Garner added that Northeast ethane production is also supported by MarkWest, and the company is delivering purity product recovered in the region and delivering it downstream. The company operates 174,000 bbld of de-ethanization capacity in the Marcellus and Utica shales. “The Northeast can supply ethane to multiple NGL consuming locations, including Canadian, Gulf Coast, and international markets, and all of our complexes have connectivity to these markets.”

Also under way is a butane-to-alkylate initiative. Alkylate is a gasoline blending component that is becoming increasingly valuable as pending new fuel regulations approach. “The U.S. still imports over 500,000 bbld of gasoline blendstock components into the Northeast, so there is an opportunity to displace imports by upgrading butane from the Marcellus and Utica into alkylate,” he said. This provides additional local demand for in-region production and opens a new supply source for refinery blendstock.

—John Needham

As noted at the February Argus Americas LPG Summit in Key Largo, Fla., the U.S. is not only the largest LPG exporter, but also the leading producer in the world, and one of the results of this exponential rise in production has been increased exports. LPG exports have surged to more than 16 million tonnes a year from a starting point of about 5 million tonnes less than 10 years ago, meanwhile transforming the global market. Additional projects to build new export facilities are planned, which could push U.S. export capacity to 40 million tonnes by 2018.

But the global LPG industry is facing a period of oversupply and rebalancing. Volatile crude oil prices are rippling throughout the downstream markets, and declines in overall energy production, both for oil and natural gas, threaten to lay down rigs and stem NGL production. “The aberration of low crude prices is becoming the new normal,” observed Nick Black, principal LPG, consulting, at Argus. “The crude price impact is hugely important.”

Craig Whitley, president and CEO of Houston-based World Energy Consultants LLC, emphasized that while most recent NGL infrastructure was built during a time of phenomenal margins, the market has changed. “It’s year two now with the same set of factors. The situation is that OPEC has flooded the oil market and has set about to cripple the U.S. oil and gas industry.” He added that low oil prices also mean low prices for naphtha, a crude-derived alternative to LPG for petrochemical cracking. While the impact of U.S. shale-based NGLs has led to record U.S. production, record export levels, including shipments to Latin America, Europe, and Asia, as well as record propane inventory levels, prices are sharply lower and many projects are under water.

Meanwhile, numerous NGL infrastructure projects have been built, among them pipelines, gas plants, fractionators, ethylene plants, propane dehydrogenation (PDH) facilities, and export terminals. Whitley underscored there are key questions for the industry. Will the world be able to absorb planned U.S. NGL production? Will U.S. NGL production volumes ever reach and sustain the levels required to financially support the infrastructure build-out?

Change is the only certainty in the oil and gas business, the former NGL analytics leader at BP affirmed, drawing attention to the recent era of energy scarcity, burgeoning import dependence, and high prices in the U.S. versus the current energy resurgence. However, certain factors remain constant, among them — LPG is a by-product of oil and natural gas. “In other words, being a byproduct of oil and gas production, LPG will never be the tail that wags the dog,” Whitley asserted. But that doesn’t mean it’s not important.

“When the oil-to-gas spread blew out producers laid down drilling rigs in dry gas shale plays like the Haynesville and moved them to liquids-rich plays like the Eagle Ford, Marcellus, Bakken, and Utica,” he pointed out. However, vulnerabilities exist, namely that most LPG comes from associated gas production, and changes in oil and associated gas production volumes will impact LPG production levels. “A classic example is the rise in U.S. NGL production that we’ve witnessed from higher production levels of oil and associated gas production related to shale oil and shale gas plays,” Whitley explained. “This direct linkage to oil is very important, as future oil production volumes will impact LPG production volumes.”

There may be some dark clouds on the horizon. The 45-year industry veteran noted that Goldman Sachs analysts recently predicted that the potential for Brent crude prices to fall to nearly $20/bbl is becoming greater as oil storages continue to fill. In addition, Saudi Arabia continues its strategy to protect market share and shows no sign of cutting back on production, despite pleas from Venezuela, Russia, and others to make cuts. Moreover, leading OPEC producers are also flexing their muscles. But why?

“OPEC never expected the huge success of shale oil, or the ability of the U.S. oil and gas industry to grow production so rapidly,” Whitley maintained. “With the entry of so many small and mid-size producers making an impact on U.S. production levels, building up debt along the way, Middle East producers feel they have a significant cost advantage and the staying power to curb U.S. production. OPEC’s strategy is to cripple the U.S. oil and gas industry, putting debt-ridden companies out of business and stemming U.S. oil production.”

He added that although monthly statistics from the Energy Information Administration do not reveal sharp drops in U.S. oil production yet, shut-ins are taking place and more bankruptcies are expected. “OPEC’s strategy is supported by the cartel’s knowledge that it has a lower cost of production than U.S. producers. While the cartel’s focus has been on increasing production, OPEC likely didn’t anticipate the slowdown in the Chinese economy would exacerbate the situation.”

Whitley observed that production drops in the U.S. have been minimal thus far due to the large number of drilled but uncompleted wells (DUCs) in early 2015. Those DUCs are said to number in the hundreds, if not thousands. As well, most producers were hedged through 2015 and there were major improvements in drilling technology, which reduced production costs. In summary, OPEC overlooked and underestimated the sheer volume of U.S. production volume that was hedged at higher prices, the number of drilled but uncompleted wells, the extremely high initial production rates from shale wells, and producer strategies related to DUCs and first-year production rates. Finally, America’s exploration and production technology continues to improve, sustaining its elevated status.

Whitley further commented that the U.S. reaction to lower oil prices was sharp and swift, proving Newton’s Third Law: “For every action, there is an equal and opposite reaction.” Technology enhancements led to more oil and gas produced per rig, and the number and lengths of laterals per well increased. But how low can oil prices go? Citing various sources, the former Purvin & Gertz senior partner reported that the United Kingdom has one of the highest marginal costs to produce a barrel of oil at $52.50/bbl, while Kuwait has one of the lowest at $8.50/bbl. The U.S. comes in at $36.20/bbl, while Venezuela is at $23.50/bbl and Russia’s cost is $17.20/bbl. Saudi Arabia’s reported production cost is $9.90/bbl. Iran, just now reentering the market after the lifting of sanctions over its nuclear program, has an estimated marginal cost of $12.60/bbl.

Does OPEC have the staying power? Although marginal production costs per barrel in the Middle East are low compared to the U.S., those costs say nothing about a nation’s fiscal budget breakeven costs when oil revenues weigh so heavily on a country’s income, wealth generation, and ability to meet its financial obligations, Whitley said. Using a fiscal budget breakeven cost calculation instead, an OPEC founding member country such as Venezuela needs $111.30/bbl; Saudi Arabia, $95.80/bbl; and Iraq, $75.90/bbl. The two remaining OPEC founding members, Iran and Kuwait, require $70.40/bbl and $51.80/bbl, respectively.

For other OPEC members, Libya is reported to require a fiscal budget breakeven price of $207.60/bbl; Algeria, $93.00/bbl; the United Arab Emirates, $67.50/bbl; and Qatar, $57.80/bbl. Outside that block, Russia’s breakeven price is $84.90/bbl. Contrast that to Brent crude, which breaks even at $31.93/bbl and West Texas Intermediate at $31.25/bbl. Undoubtedly, some OPEC members cannot sustain the current course. Even the deep-pocketed Saudis, which have rich financial reserves, have been calling upon those reserves to fill gaps in the domestic budget absent higher oil prices.

But while members of OPEC decide whether to hang together or hang separately, Whitley acknowledged the cartel’s strategy has achieved results. The price impact of surplus oil and LPG production have oil and propane on an MMBtu basis collapsing and moving toward gas values. “The gas-to-oil wedge is approaching historical levels,” he said. “Heating values for propane broke away from oil’s Btu value in late 2011 and remain lower than oil’s heating value.” Meanwhile, U.S. propane production and exports continued to rise even as prices plummeted.

However, lucky or unexpected factors fortunately aided the disposition of U.S. propane supplies. As outlined by Whitley, new Middle East supply projects have not evolved at the level and speed once expected by the industry. Also, LPG supply declines in Venezuela, delays in Brazilian LPG supply projects, lack of additional LPG developments in Peru, and new supplies from Colombia not meeting expectations are in play in Latin America. A notable exception is Bolivia, which has new supply initiatives under way, but the nation is a land-locked country. Further, China’s shale gas is mostly dry gas, and Argentina’s shale production has yet to make an impact. At the same time, lower oil prices are translating to reduced drilling activity and fewer LPG supply projects globally. Also, China’s PDH demand became a reality, diverting U.S. barrels to serve that sector.

He cautioned that there is evidence of a global LPG supply surplus, and that the industry shouldn’t overlook global residential/commercial demand, which accounts for 46% of the total world market, followed by the chemical sector at 22%. The global residential/commercial sector grows roughly 3.0 to 3.3 million tonnes a year, or 96,000 bbld to 106,000 bbld, “hence roughly half of world LPG demand doesn’t have sufficient growth to support the huge rise planned for U.S. NGL production.” Whitley added that U.S. NGL producers and exporters are more dependent on price-sensitive demand growth and/or declines in foreign LPG supply than they realize. However, American PDH plants coming online will play a role in clearing some surplus propane supply.

“We can expect modest residential/commercial LPG demand growth to continue in future years as long as the world population is growing and the global economy isn’t suffering,” said Whitley. “Global residential/commercial LPG demand has grown as much as 7 million tonnes in good years and has realized annual declines during bleak economic times. Looking at the other side of the issue, if LPG can’t compete with naphtha, gasoline, or HFO [heavy fueloil], the global LPG industry will not have sufficient price-sensitive LPG market demand to consume the vast volumes of shale-based LPG that U.S. producers and exporters have planned.”

Looking forward, the World Energy Consultants CEO invoked economic fundamentals, namely the Third Law of Supply and Demand: If demand increases and supply remains the same, a shortage will occur, triggering an upward trend in prices to incentivize new supply. If demand decreases and supply remains the same, a surplus will evolve, creating a downward trend in prices to incentivize new demand. If supply increases and demand remains the same, a surplus will evolve causing prices to trend downward to incentivize new demand. Finally, if supply decreases and demand remains the same, a shortage will evolve causing prices to trend higher to incentivize new supply.

But has the Third Law of Supply and Demand engaged? Yes, but with provisos. As Whitley explained, oil and LPG prices have plummeted to stimulate new demand, but demand has failed to rise sufficiently to stop the price plummet. The more OPEC and U.S. energy production has risen, the lower oil and LPG prices have dropped. Low oil prices mean lower naphtha prices, making it difficult for LPG to gain new petrochemical market share. U.S. propane exports continue to rise, but low oil prices mean lower fueloil and diesel prices, making it difficult for LPG to gain traction in the power generation market. And low natural gas and LNG prices have also limited gas spiking demand for LPG. “U.S. propane exporters can thank a slowdown in Middle East supply growth and drops in LATAM [Latin American] production levels,” he said.

Whitley spotlighted that both oil and LPG are looking for Asia to solve surplus supply issues. However, the state of the Chinese economy is in question. Therefore, slower economic growth threatens to negatively impact Chinese oil and LPG demand. He noted that India “continues to do well and LPG demand growth is healthy,” but the Middle East has a huge freight advantage over U.S. supply due to the region’s proximity. “Japan, Korea, and Taiwan are very mature markets. South Korea does plan one new PDH plant. Most of Indonesia’s LPG demand growth from kerosene fuel-switching has already been realized.” He concluded that new PDH capacity, Asia Pacific light-ends (ethylene) cracking, and growth in China’s LPG import volumes are essential factors needed to balance global LPG supply with demand if shale gas production continues to grow.

He forecast the most likely outcome for how global supply will balance with demand. OPEC members are feeling the pinch of low prices, yet U.S. production volumes haven’t buckled to the degree the cartel hoped for. But this will change as hedges expire. Evidence that shut-ins are occurring already exist. “Despite restlessness and publicized disagreements among cartel members, OPEC will likely hold strong to its strategy for several more months,” Whitley predicted. “This could lead to Venezuela’s default. Prices will likely go even lower, leading to the production drops needed to balance global oil and LPG markets, but decisions will be made about oil, not LPG.”

On the positive side, he added that traders and analysts will see production declines as the indicator they have been looking for to support a price turnaround. “Expect higher prices before year-end. Meanwhile, the Saudis can hold on longer due to their vast cash reserves. Don’t be surprised if they enforce their strategy until they see several months of U.S. oil production declines and evidence that companies are crumbling apart or consolidating.”

Whitley concluded that the problem with global LPG supply is mostly a propane over-supply issue. It remains manageable, but could get worse if production continues to grow. In tandem, price-sensitive demand is hampered by low naphtha, HFO, diesel, and natural gas prices. But lower-than-expected LPG supply from Latin America and the Middle East has been a blessing in disguise for U.S. propane exporters. “The ‘Field of Dreams’ ‘build it and they will come’ mentality of American oil and gas producers has flooded the market with NGLs, leading to widespread ethane rejection, all-time high exports, and inventory levels,” he detailed. “These are bad times, but our industry will recover over the next six to 24 months.”

Nevertheless, on the way to that recovery names, faces, and ownership may change, he said. Return on investment on shale assets may fall below forecasts for a few years, but will prove warranted over time. “The early success that U.S. LPG producers and exporters have enjoyed in the international arena won’t be viewed as a fluke in future years. Foreign interest in U.S. LPG supply remains high. We’ve proven the international community needs U.S. LPG supply. Regardless of how 2016 turns out, the world will become even more dependent on U.S. LPG supply in future years.”

Market participants are readying for an even larger U.S. LPG export space. With terminal capacity-holders now reselling cargos and swapping loading dates, a new, robust LPG spot market is starting to emerge that is providing traders with liquidity and price discovery clarity. And that market is poised to grow as more terminal capacity comes online, more VLGCs are delivered, and new arbitrage opportunities open and close.

Argus explains that market forces set the price. U.S. Gulf Coast propane is heavily discounted, and as the arbitrage from the Gulf and other regions and spot freight rates move continually, term lifters at U.S. export terminals sometimes determine it is more profitable to resell a cargo than cancel it altogether. A term buyer will calculate the difference between the agreed cost of loading and the agreed cancellation fee, and then attempt to resell the cargo above the differential in the spot fob market.

For example, a term lifter who agreed to a terminalling fee of Mont Belvieu plus 8 cents/gal. may resell cargos at Mont Belvieu plus 3 cents/gal. rather than face an agreed 6 cents/gal. cancellation fee. If the difference between the terminalling fee and the cancellation fee — in this case 2 cents/gal. — is less than the spot fob price, then the term buyer will benefit from reselling the cargo rather than canceling it.

In other situations, the arbitrage to move cargos to other regions may be open, but the term lifter may have no access to a vessel. This may force the lifter to sell the allotted cargo on a spot basis, or perhaps swap loading dates with another lifter in a similar predicament. Traders and other buyers of these resold cargos are monitoring spot fob prices closely to take full advantage of opportunities, Argus comments. Further, the cost of moving propane out of the U.S. Gulf can vary enormously, depending on global demand for vessels. Owners of VLGCs typically charter them out on a dollars-per-day basis, although some will occasionally offer a dollars-per-tonne price for a single spot voyage.

But where will all that supply for traders to buy and sell originate? Scott Garner, vice president, corporate development and joint venture management at MarkWest Energy Partners (Denver), pointed out to Argus Americas LPG Summit participants that the Marcellus and Utica shales are the leading U.S. natural gas growth plays. “This has meant a paradigm shift from the U.S. Northeast being a significant importer to a significant exporter,” he said. “Driven by Marcellus and Utica production growth, infrastructure continuing to be built out reflects those changes in trade flows.”

Garner noted that MarkWest operates 41 processing and fractionation facilities in the Marcellus and Utica shales and has 10 additional facilities under construction. “We currently process and fractionate approximately three-quarters of growing production from rich-gas areas in the Northeast. We have extensive long-term producer partnerships, with Marcellus and Utica area dedications of about 8 million acres.”

Online is 1 Bcfd of gathering capacity in the Marcellus, as well as 4 Bcfd of processing capacity and 357,000 bbld of C2-plus fractionation capability. Under construction is 1 Bcfd of cryogenic capacity and 124,000 bbld of shared fractionation capacity. In the Utica, MarkWest alone operates 1 Bcfd of gathering capacity, 1.3 Bcfd of processing capacity, and 160,000 bbld of fractionation volume. Another 200 MMcfd of cryogenic capacity and 60,000 bbld of shared C3-plus fractionation capacity is under construction.

Garner outlined that Northeast NGL supply is rapidly increasing, and is forecast to account for 25% of total U.S. production in 2025. “‘Marcutica’ growth is seen even in a low commodity price environment,” he said, referring to the two shale plays. “Current NGL pricing is challenging. However, Mariner East, Cornerstone, and additional projects will return balance to Northeast supply and demand. Exports from the Northeast are geographically and structurally advantaged to Europe and parts of South America.”

Sunoco Logistics Partners LP (Philadelphia) said in March that Mariner East 1, the first pipeline in the company’s larger Mariner East system, was transporting propane and ethane to the Marcus Hook Industrial Complex and is approaching full operations as it completed loading of the first waterborne ethane shipment. Mariner East 1 is the first phase of the multifaceted Mariner East project. With the first pipeline up and running, the Marcus Hook Industrial Complex is positioned as an East Coast hub for processing and storing propane, ethane, and other NGLs from shale basins for distribution to local, domestic, and international markets. The 70,000 bbld of ethane and propane capacity for Mariner East 1 is available for intrastate and interstate service.

Mariner East 1, which originates in Washington County, southwest of Pittsburgh, began shipping propane in December 2014, serving local and regional propane shippers as well as the international market. Ethane shipments commenced last month, and the first tanker carrying ethane to Europe departed from Marcus Hook March 9. Mariner East 2, an expansion of the Mariner East system with origin points in Ohio, West Virginia, and western Pennsylvania, will add additional off-take points for propane shippers in central and eastern Pennsylvania. It is expected to be completed in the first half of 2017 and will add an additional 275,000 bbld of capacity for NGLs, primarily propane and butane, from the Marcellus and Utica shales. Mariner East 2 will provide both interstate service and intrastate service within Pennsylvania and has the potential to expand to 450,000 bbld.

The Cornerstone Pipeline and associated Utica build-out projects are initiatives of Marathon Pipe Line LLC and Ohio River Pipe Line LLC, subsidiaries of MPLX LP, a master limited partnership formed by Marathon Petroleum Corp. (Findlay, Ohio) in 2012. MarkWest Energy Partners is a wholly owned subsidiary of MPLX. The Cornerstone Pipeline will originate in Harrison County, Ohio and will deliver to Marathon Petroleum’s Canton, Ohio refinery and to an affiliated tank farm in East Sparta, Ohio. Cornerstone is being designed as a 16-in.-dia. system routed to provide connections to various Utica Shale condensate stabilization facilities, fractionators, and cryogenic facilities, along with potential future gathering and storage facilities. Cornerstone will be a batched system with the ability to transport condensate and NGLs.

The $2.2 billion allocated to Marathon Petroleum’s pipeline transportation segment this year includes $1.7 billion for MPLX. The largest component of the investment plan, more than $1.2 billion, is attributed to MarkWest’s ongoing development of natural gas and gas liquids infrastructure to support producer customers throughout the Southwest and Northeast regions, particularly in the Marcellus and Utica shales. MPLX continues its development of the Cornerstone Pipeline and is further expanding its Utica Shale build-out associated with the project.

Garner reported that a 23,000-bbld condensate stabilization facility was completed a year ago that will connect Utica and Marcellus NGLs to refinery and petrochemical markets. The facility will serve as the origin for the Cornerstone pipeline, delivering stabilized condensate to MPLX’s pipeline network. He noted that Cornerstone and the associated Utica build-out projects will provide optionality to multiple markets, maximizing producer netbacks and providing flexibility of commitment terms and seasonal shipper needs. Construction timetables are flexibly designed to allow MPLX to complete projects in phases as Utica production grows.

He characterized the infrastructure build-out as “developing Mont Belvieu capabilities in the Northeast” that will facilitate product exports to Canada and deliveries to the Gulf Coast for use in-region or for exports, to the Midwest, and to East Coast refineries and petrochemical facilities. “MarkWest’s NGL fractionation and marketing infrastructure is integral to supporting the abundant NGL supply in the Northeast,” he said. “Export facilities at multiple locations on the Eastern Seaboard will bring the Northeast back into supply balance, and growing regional NGL demand will come from refining, blending, and petrochemical projects.”

Garner added that Northeast ethane production is also supported by MarkWest, and the company is delivering purity product recovered in the region and delivering it downstream. The company operates 174,000 bbld of de-ethanization capacity in the Marcellus and Utica shales. “The Northeast can supply ethane to multiple NGL consuming locations, including Canadian, Gulf Coast, and international markets, and all of our complexes have connectivity to these markets.”

Also under way is a butane-to-alkylate initiative. Alkylate is a gasoline blending component that is becoming increasingly valuable as pending new fuel regulations approach. “The U.S. still imports over 500,000 bbld of gasoline blendstock components into the Northeast, so there is an opportunity to displace imports by upgrading butane from the Marcellus and Utica into alkylate,” he said. This provides additional local demand for in-region production and opens a new supply source for refinery blendstock.

—John Needham